Integrations

Stripe for Global

Online Payment Platform - Europe

Online payment platform (http://onlinepaymentplatform.com/). This payment gateway has been integrated into our ecommerce platform to allow for secure and convenient online transactions.

Particularly helpful for anyone launching marketplaces in Germany

Country supported : Germany

Getting Started

To start using the online payment platform, you will need to sign up for an account at http://onlinepaymentplatform.com/. Once you have created an account, you can then integrate the payment gateway into Tradly by going to `Superadmin > settings > Payment Gateways`

Features

Single payments: Allows users to make straightforward payments to merchants.

Multi-split payments for Marketplaces: Provides flexibility to split one transaction into multiple payouts.

Escrow solution: Allows users to control the payout of a transaction to ensure that certain conditions have been met before the funds are paid out to the merchant.

Recurring payments: Allows users to set up automatic, recurring payments.

PSD2 compliant: Ensures that the payment solution complies with the European PSD2 and GDPR legislation.

Verified sellers: Provides a secure and scalable platform with trustworthy sellers.

Dispute handling: Offers independent support to help resolve disputes between buyers and sellers based on set agreements.

Platform insights: Provides live statistics and relevant information through an API and interface for both the platform and sellers.

\

BillPlz for Malaysia

PayDunya for Africa

MangoPay - Europe & US

Tradly is proud to be integrated with one of the industry leading marketplace payment/payout solutions.

Go to SuperAdmin > Settings > Payments > Add MangoPay > And then configure the keys. https://superadmin.tradly.app/payments

About MangoPay

Trusted by 2,500+ businesses.Globally.

Future-proof your marketplace and platform with flexible payment and fintech solutions that scale.

Use cases

E-wallet

Flexible e-wallet infrastructure to collect, move, split, reuse, payout and automatically reconcile funds. Embed within your platform to offer built-in fund management to sellers.

Payments

Powerful payment processing with great control. Build dynamic card, bank and alternative payment flows that drive conversion and grow revenue.

Payout

Fast and cost-effective global and local payouts in the currencies you need. Payout on demand or on schedule through batch or sequence and reduce Payment ops burden.

Razorpay - Online Payments India

Online Payments India: Start Accepting Payments Instantly with Razorpay's Payment suite, which Supports Netbanking, Credit card & Debit Cards, UPI, etc

Supercharge your business with the all‑powerful Payment Gateway

100+ Payment Methods

Industry Leading Success Rate

Superior Checkout Experience

Easy to Integrate

Instant Settlements from day 1

In-depth Reporting and Insights

Instant Activation

Get activated and transact within 2 minutes. Completely online onboarding with minimum documentation.

Easy Integration

With plugins for all major platforms and languages, integrate and go live with Razorpay in less than an hour.

API Driven

Build your business for scale with our complete API-driven automation that requires zero manual intervention.

100+ payment modes

Offer your customers the luxury of all payment modes including Credit/Debit cards, Netbanking, UPI, Wallets etc.

Simple Pricing

Our innovative payment solutions with competitive pricing make payments simpler.

Best in Industry Support

Always available email, phone and chat based support to help you in your every step.

Dashboard Reporting

Real-time data and insights on your Razorpay Dashboard to make informed business decisions.

Secure

PCI DSS Level 1 compliant solution which removes your burden of regulatory compliance.

Pawapay - Payment Gateway for Africa

pawaPay provides the complete solution for mobile money

Grow your business with frictionless access to over 218m customers in 19 countries. With just one integration, you can manage everything from a single dashboard and enjoy consolidated treasury, resulting in the lowest overhead for managing mobile money.

Get started immediately

Create your free account to see how pawaPay integrates mobile money into your payment flows. From your account you will be quickly guided through our onboarding for a fast and successful launch.

Pan-African

With a single integration, you can provide mobile money payments to customers in one country or roll out to 19 countries without friction.

Consolidated treasury

We are your one-stop partner for moving money in and out of mobile money accounts across Africa, tailored to your specific needs. We support all major currencies.

Payments

Collect from, refund and disburse to your customers mobile money wallets with ease.

Management

Everything you need to manage mobile money is unified into a single dashboard. All payments are fully reconciled and tracked in real-time, enabling high quality support when it matters the most. Live balances and standardised financial statements make financial planning and reconciliation simple.

Video Tutorial

For a complete walkthrough, watch the YouTube guide below:

KoraPay

What is KoraPay?

KoraPay is a secure online payment gateway that enables businesses to accept payments across Africa. It supports multiple payment methods like bank transfers, cards, and wallets — making it easy for customers to pay online.

Why integrate KoraPay with Tradly?

Once connected, your marketplace can:

Accept online payments instantly

Automatically confirm orders after successful payment

Offer modern African payment options

Reduce fraud using secure API-based verification

Where Kora is Available

Kora enables mobile-money payments in the following countries and currencies: Kenya (KES), Ghana (GHS), Cameroon (XAF), Côte d’Ivoire (XOF), Egypt (EGP), and Tanzania (TZS).

It also supports cross-border collections and settlements across Africa via its pan-African payment infrastructure.

How It Works

KoraPay provides secret API keys.

You copy those keys into your Tradly SuperAdmin panel.

Your customers will then see KoraPay as a payment option during checkout.

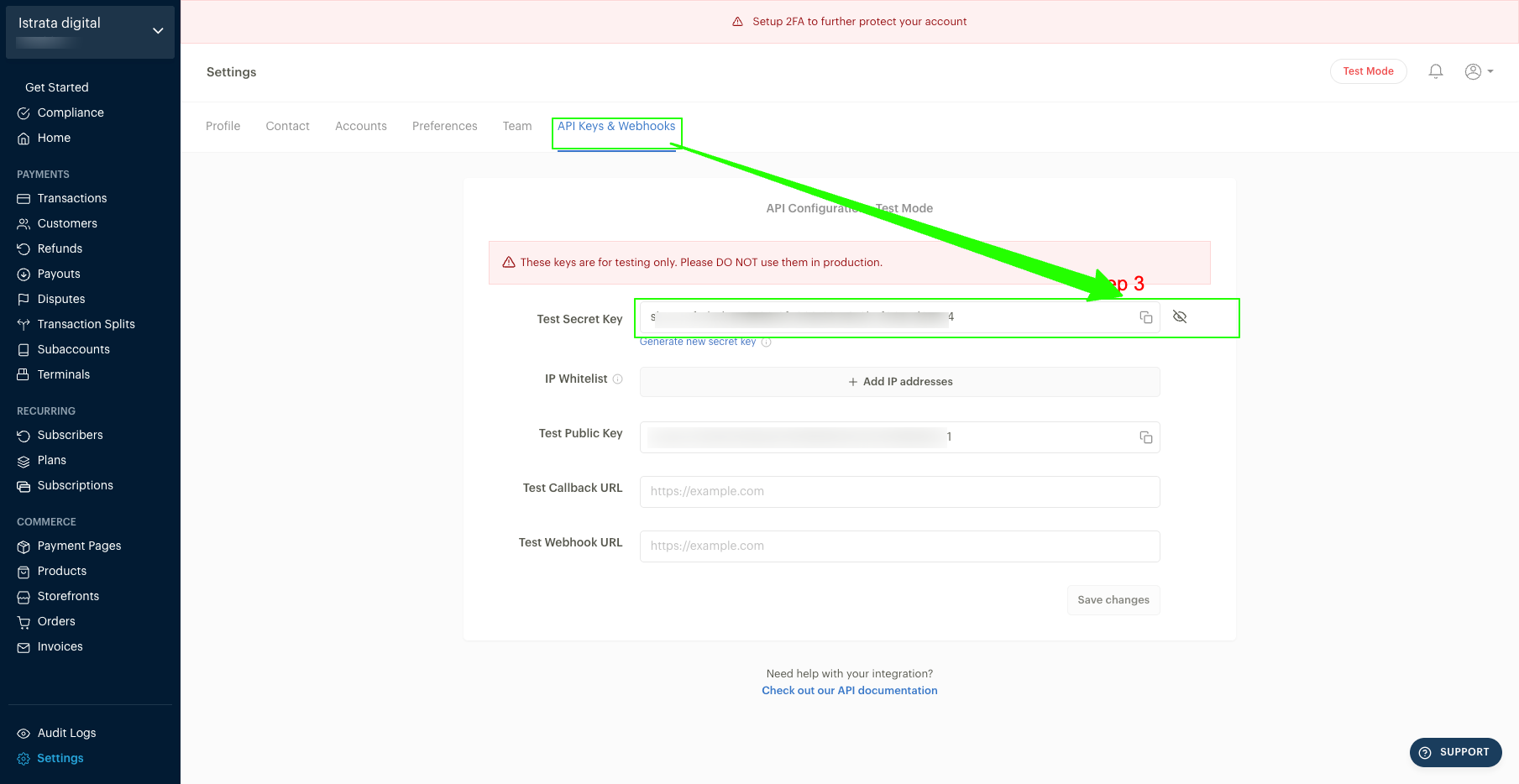

Part 1: Get Your API Key From KoraPay Dashboard

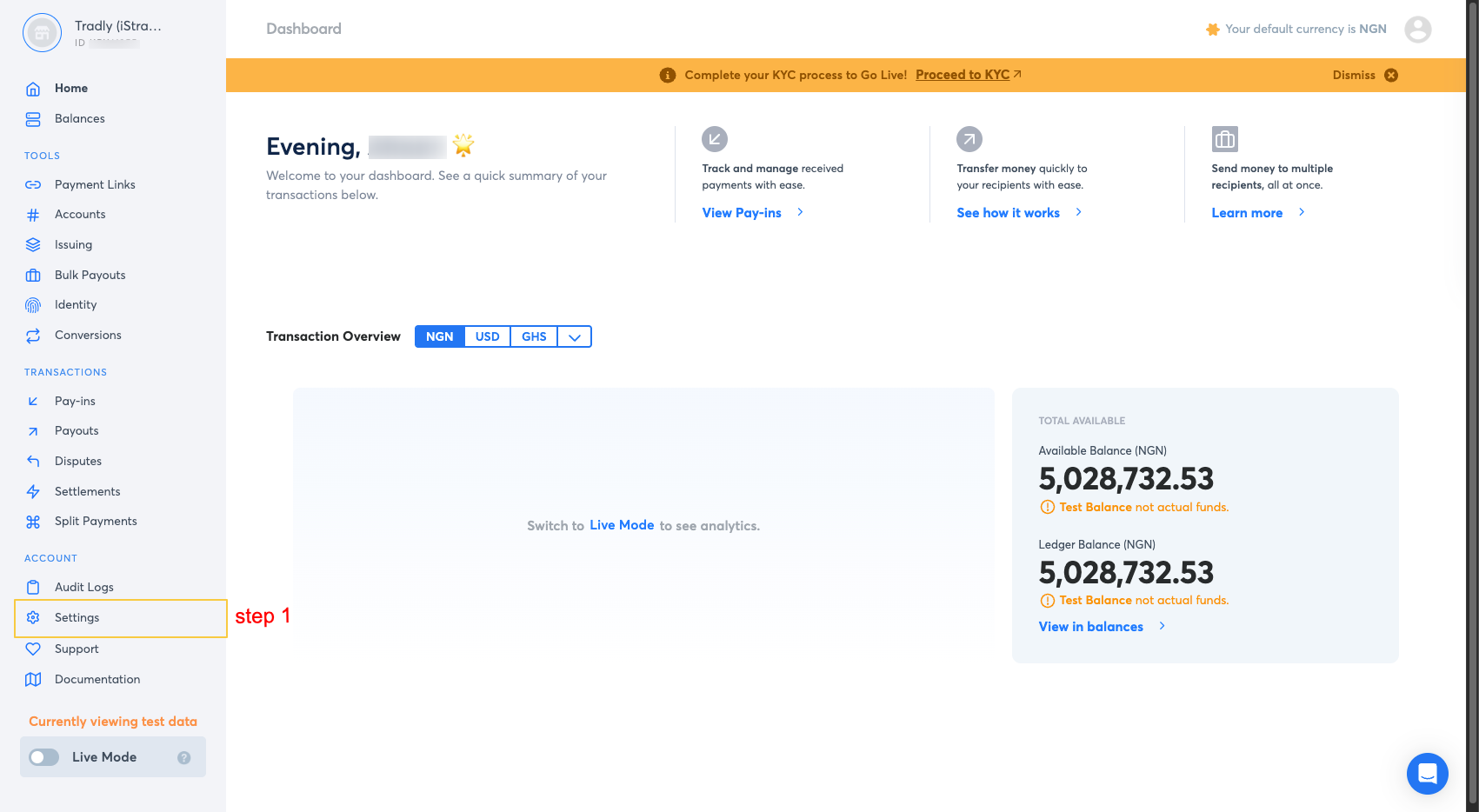

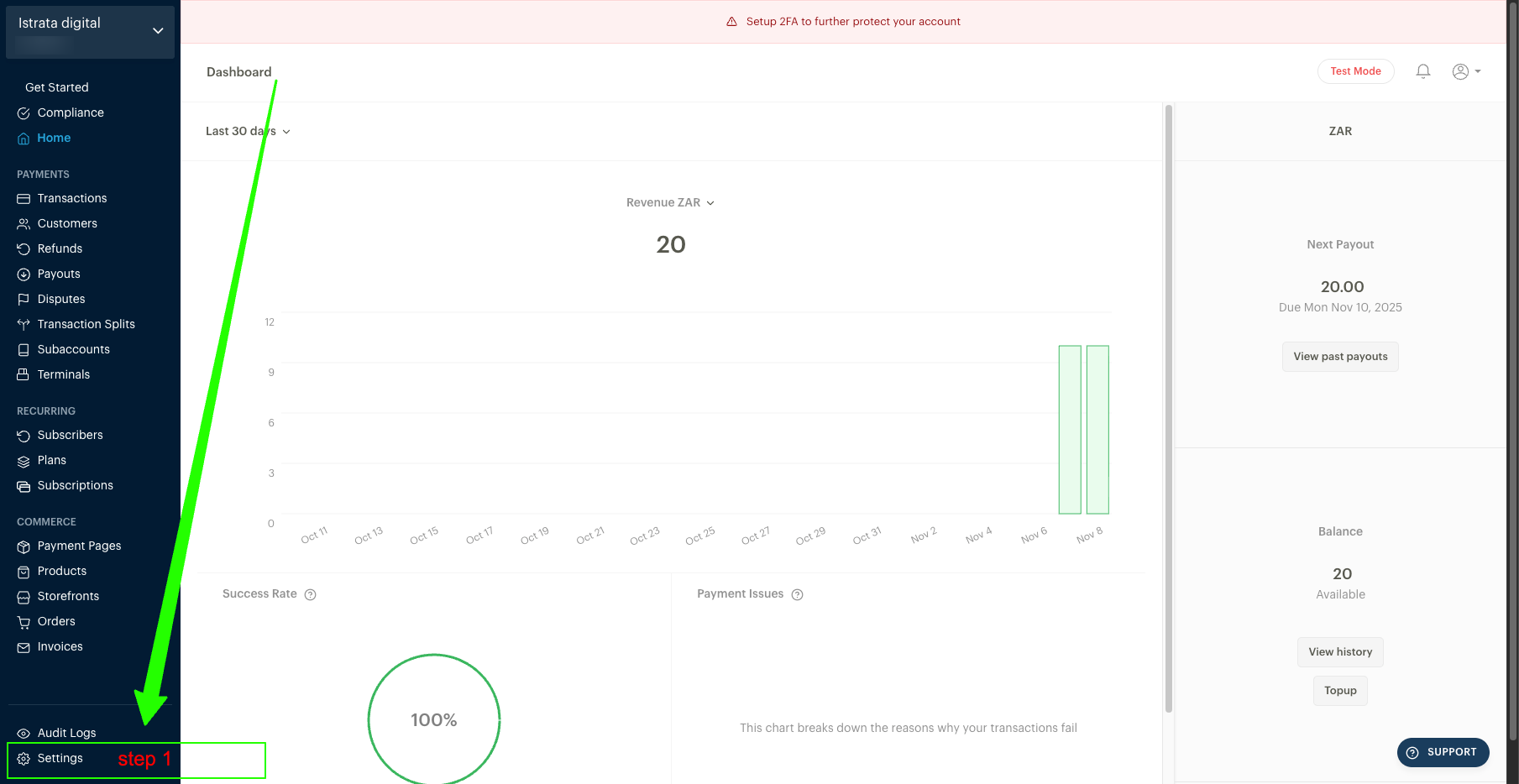

✅ Step 1 — Go to Settings

From the left sidebar > click Settings : https://merchant.korapay.com/dashboard/home

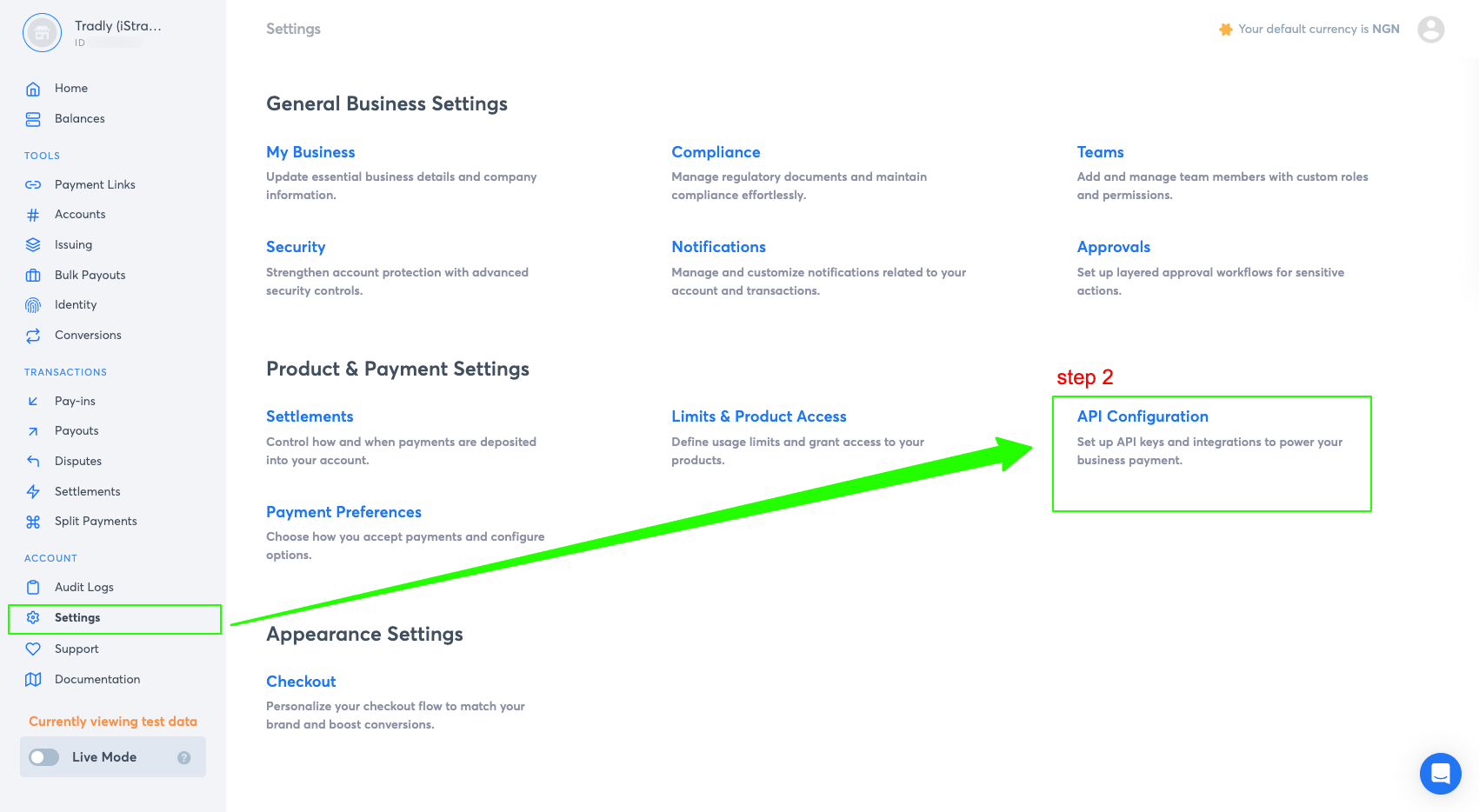

✅ Step 2 — Open API Configuration

Product & Payment Settings → API Configuration

https://merchant.korapay.com/dashboard/settings

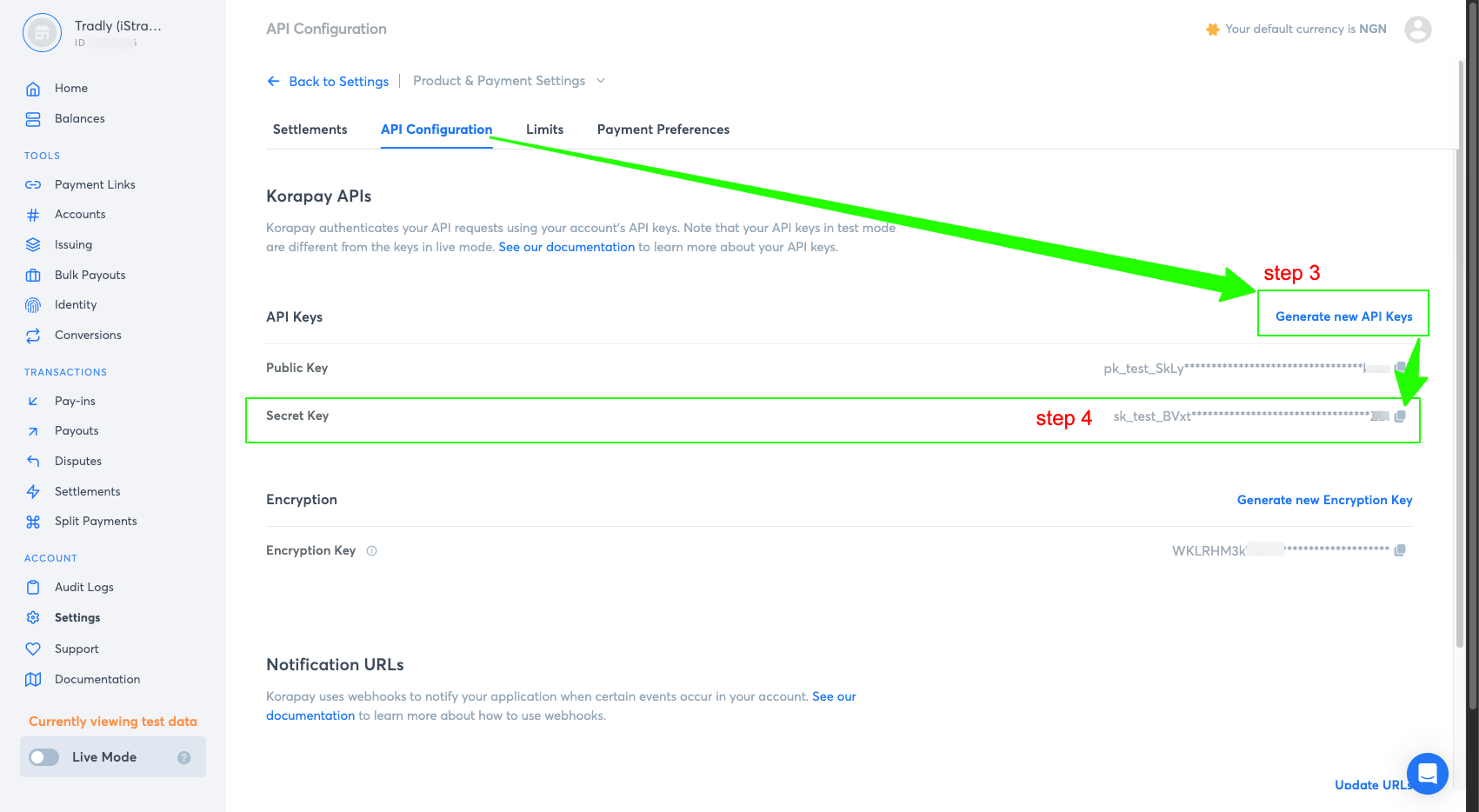

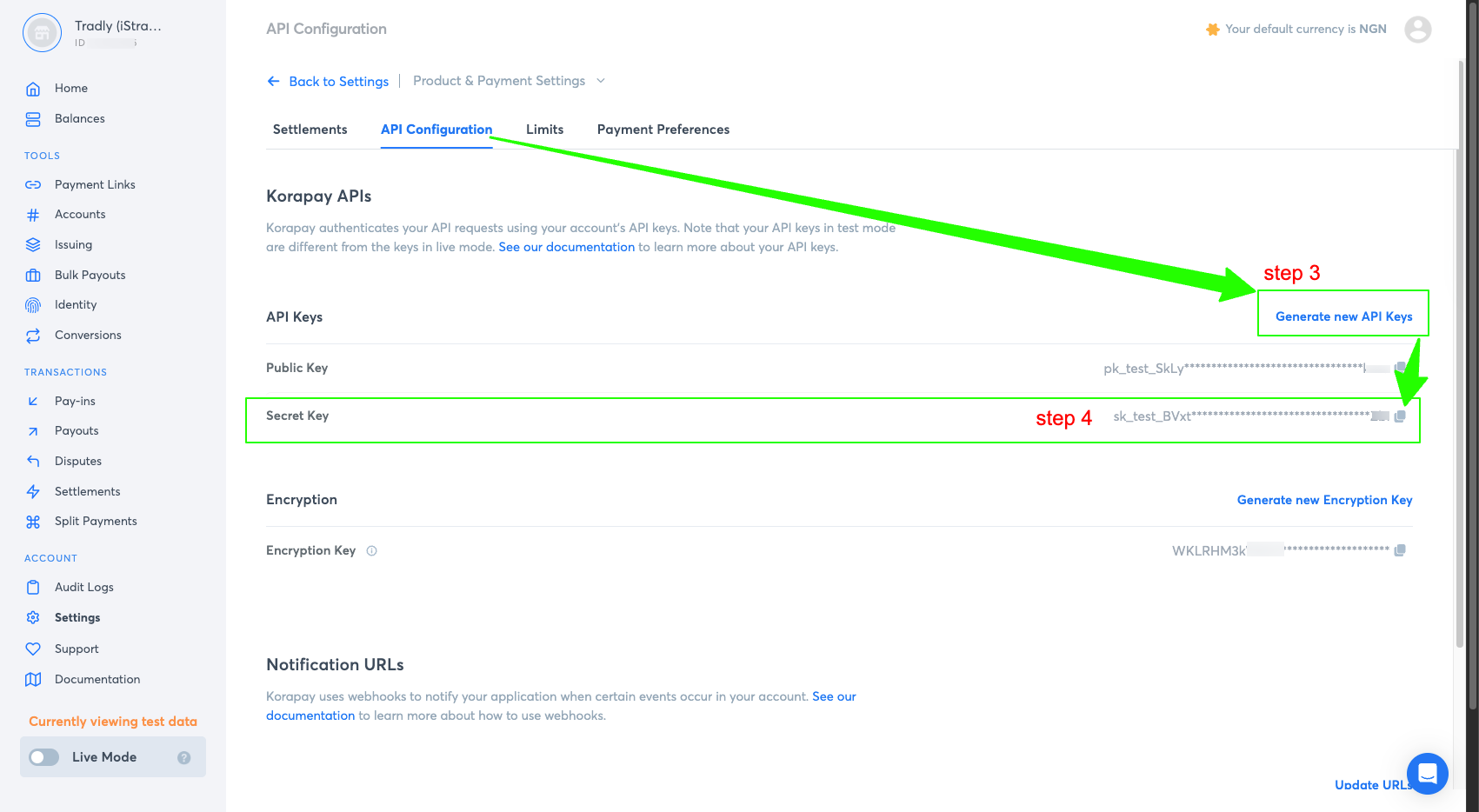

✅ Step 3 — Generate API Keys

Click Generate new API Keys if you dont have any secret key there.

https://merchant.korapay.com/dashboard/settings/api-integrations

✅ Step 4 — Copy Secret Key

You will see:

Field | Meaning |

|---|---|

Public Key | Used for front-end scripts (not required for Tradly) |

Secret Key | 🔐 Used to securely connect your store — copy this one |

✅ You only need the Secret Key for Tradly

Keep it safe — do not share publicly.

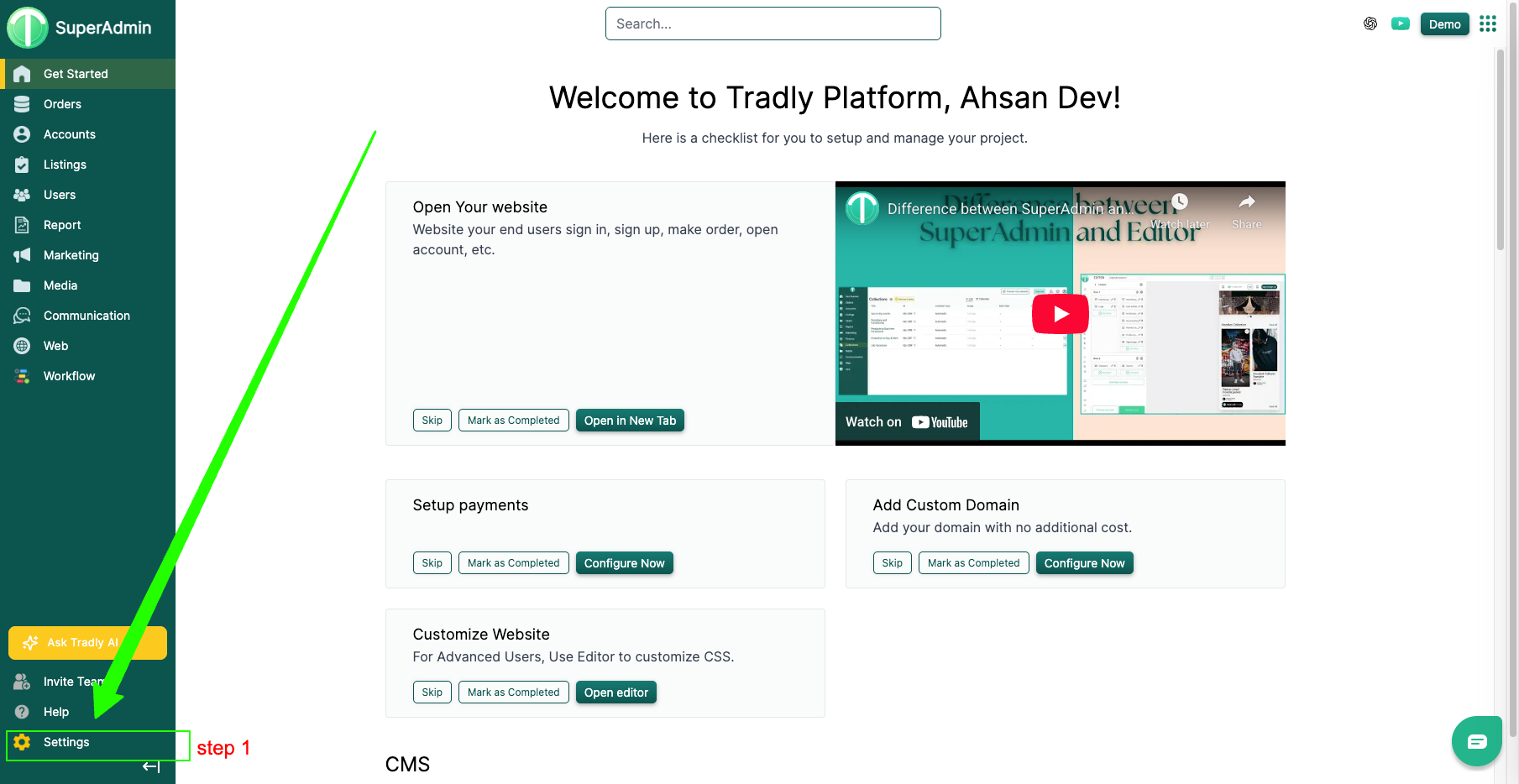

Part 2: Add KoraPay in Tradly SuperAdmin

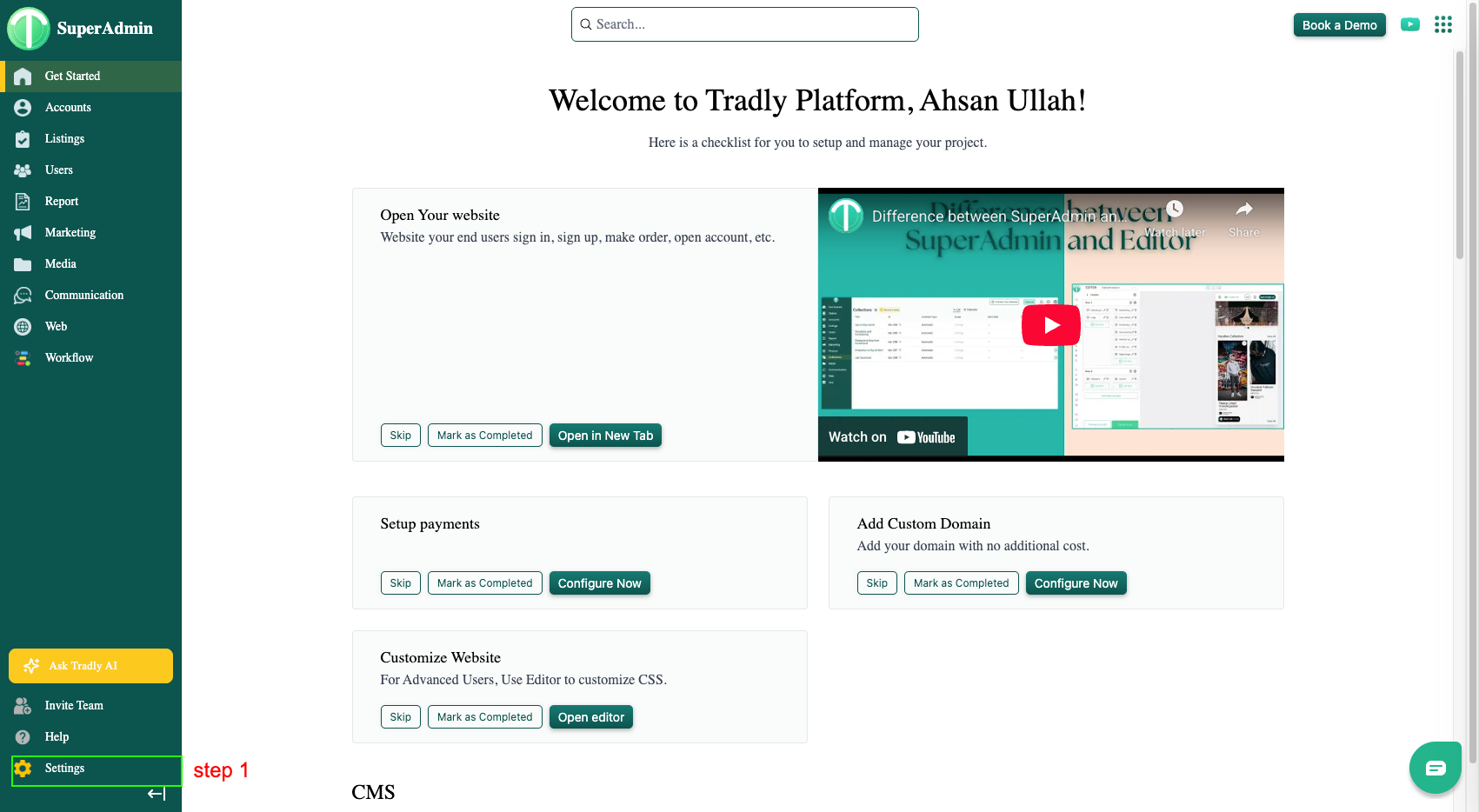

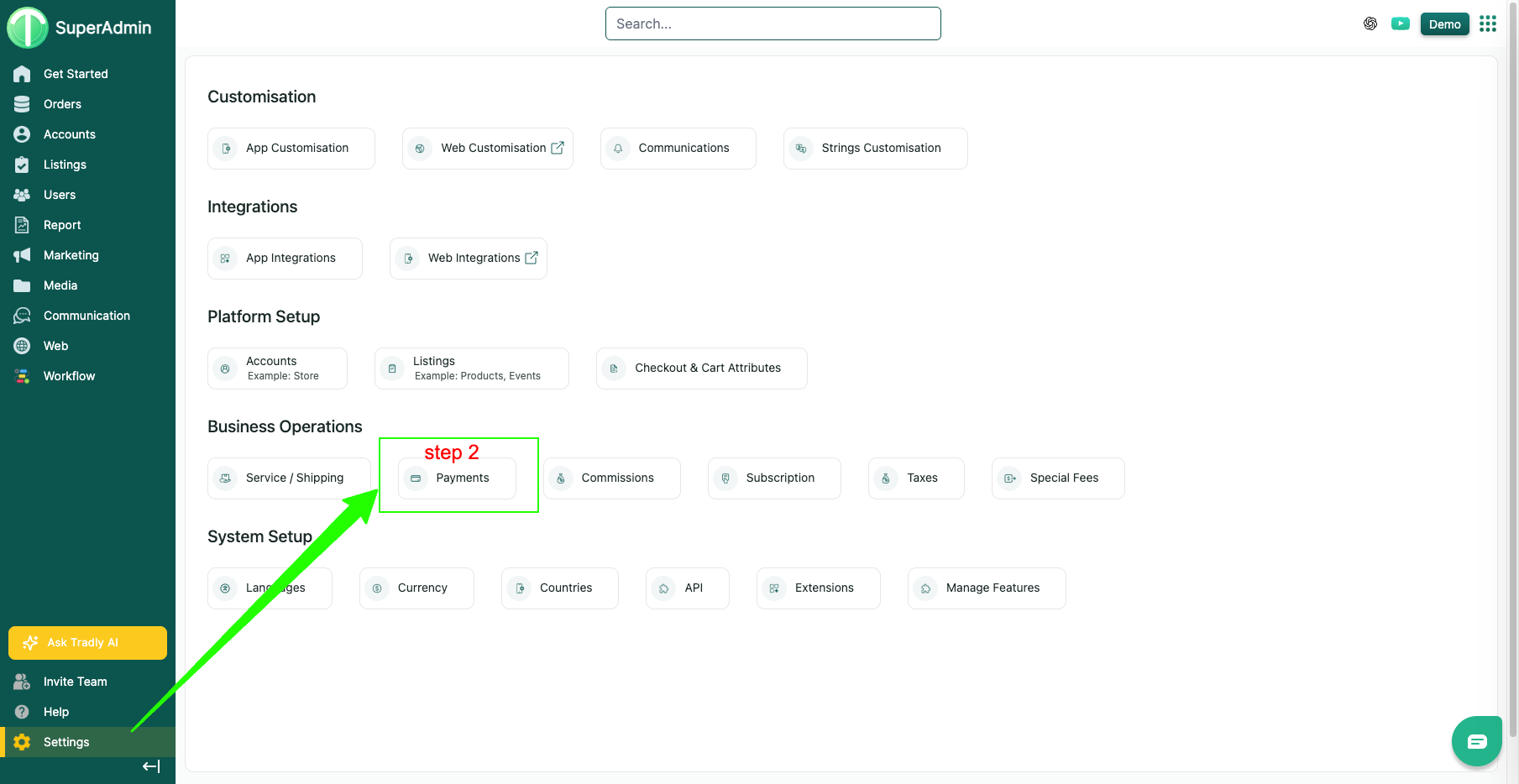

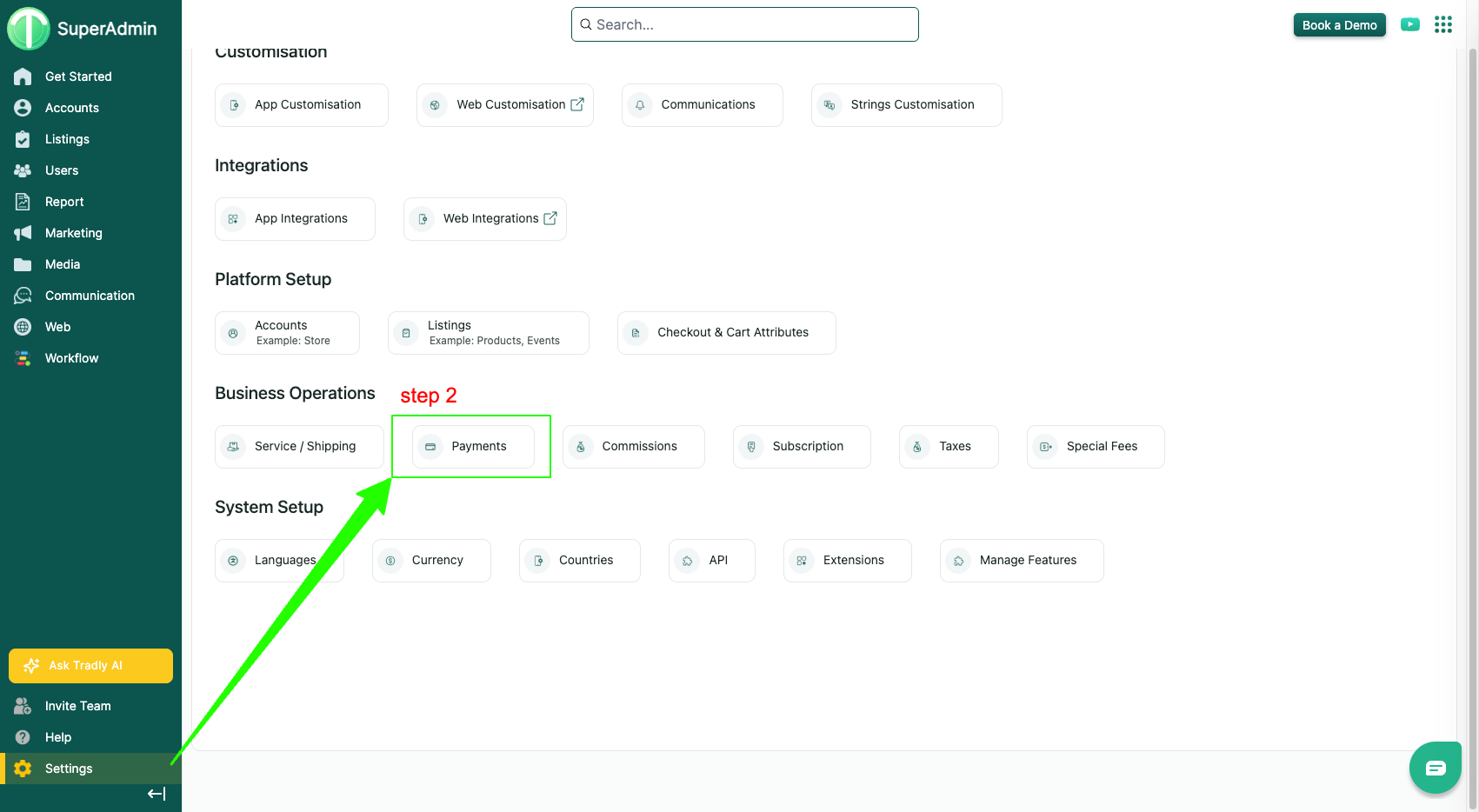

✅ Step 1 — Open Settings

Left sidebar → Settings

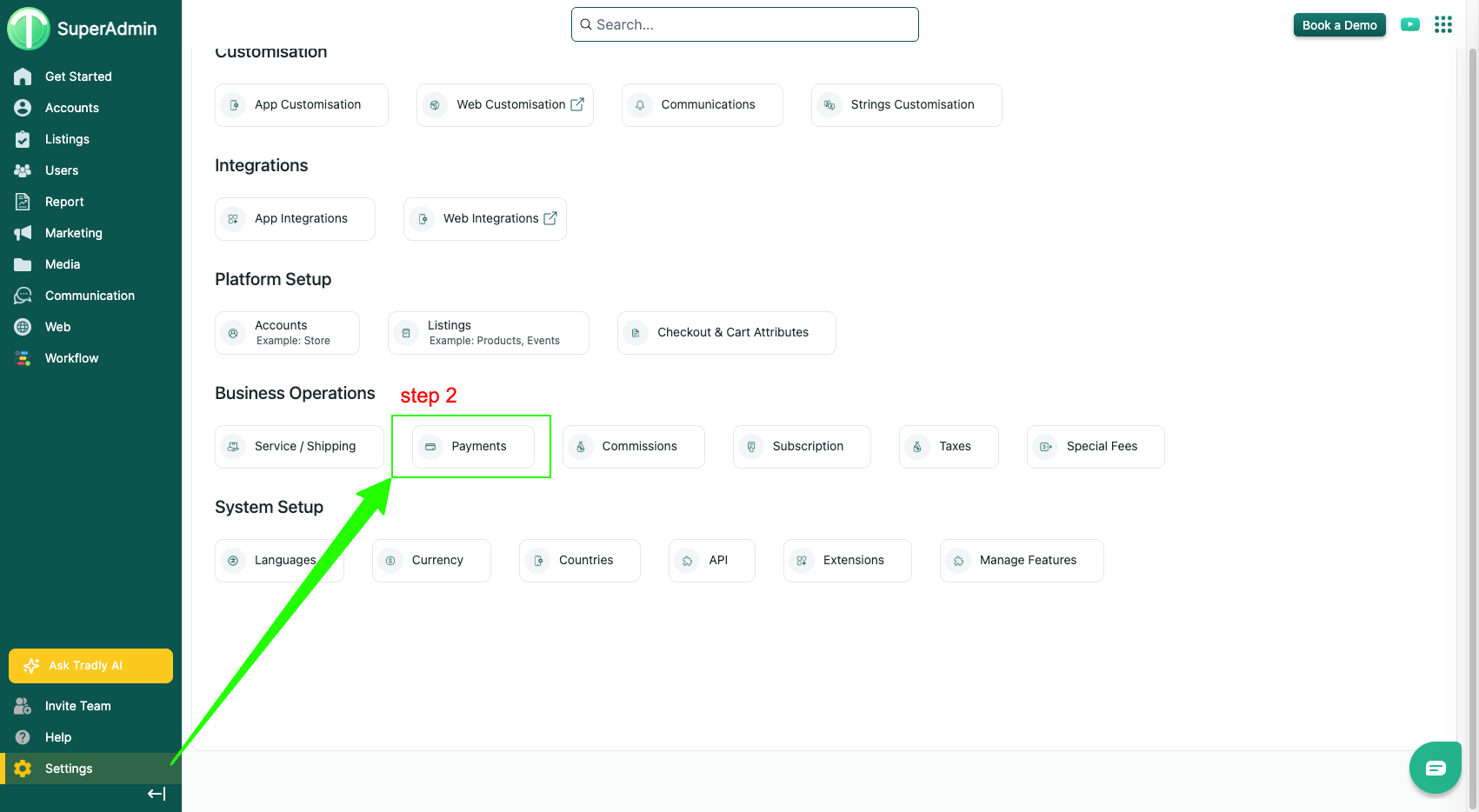

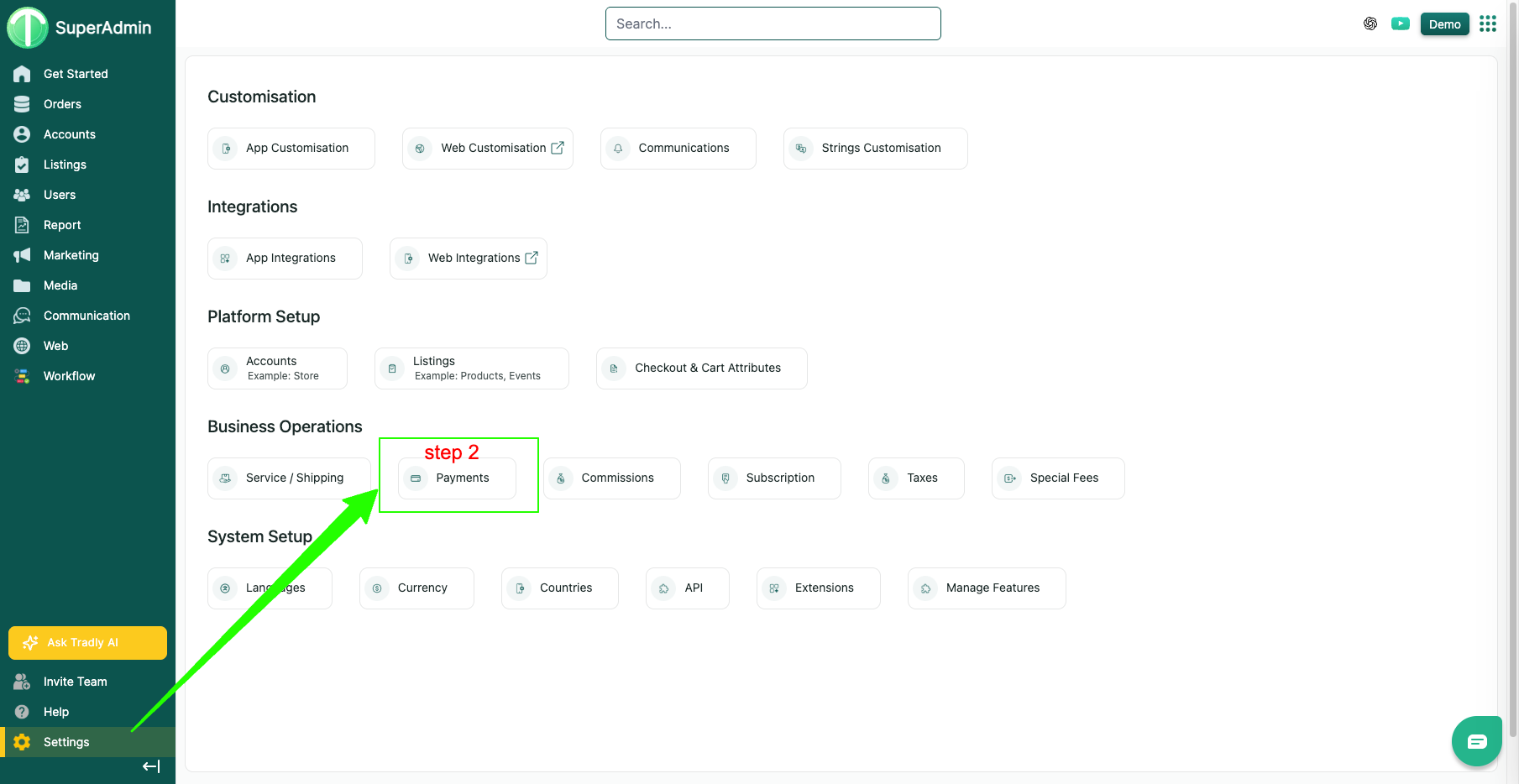

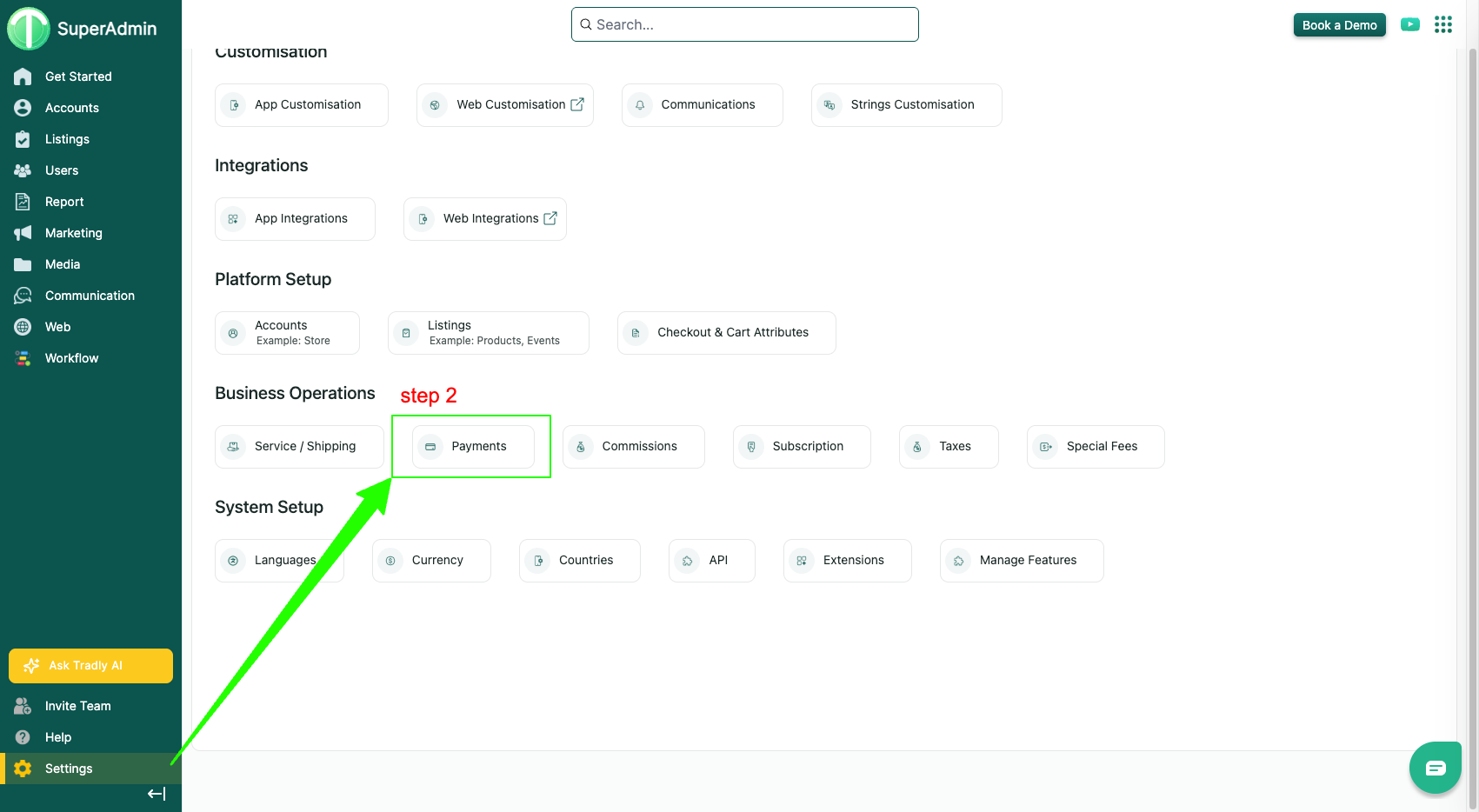

✅ Step 2 — Go to Payments

Under Business Operations → Payments

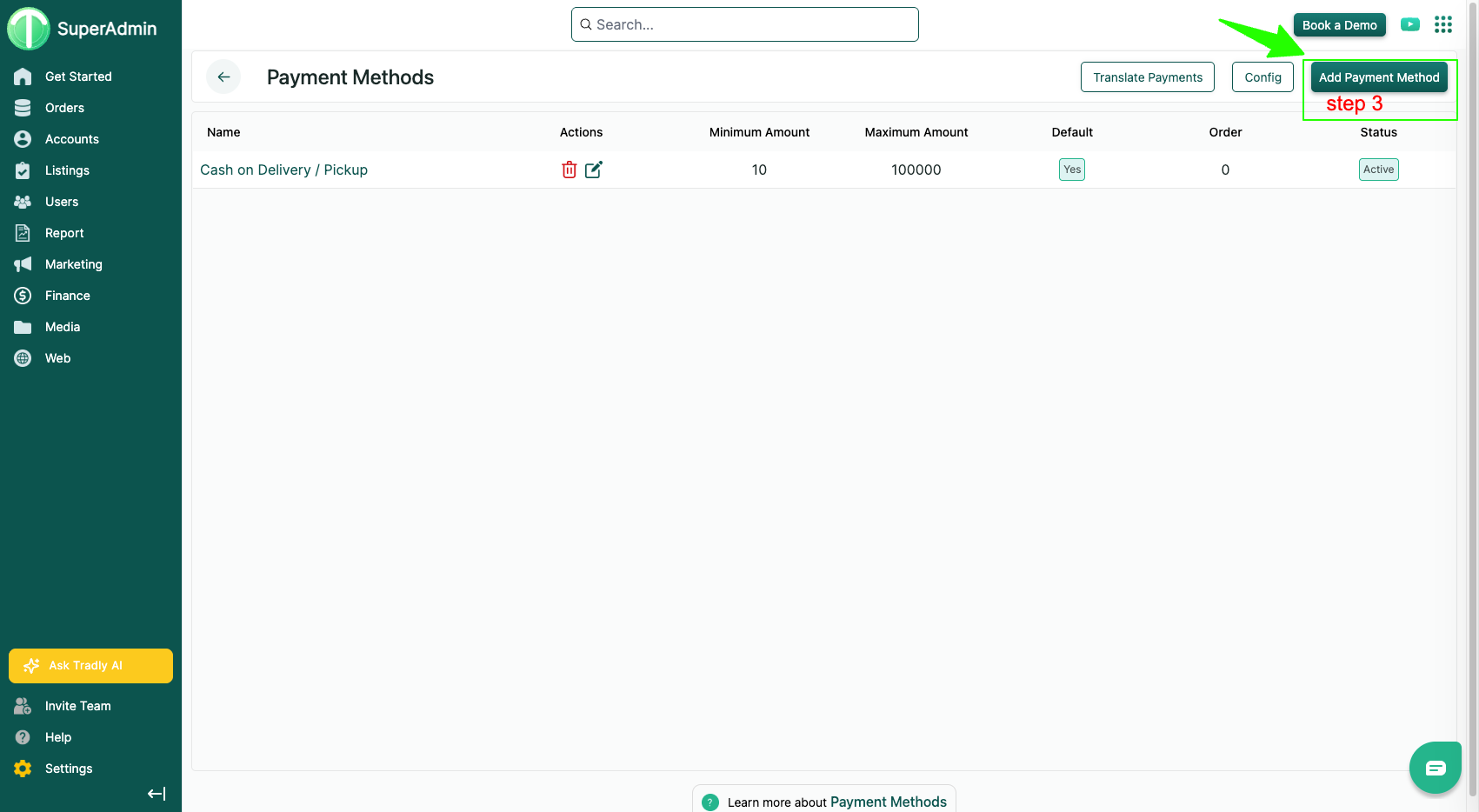

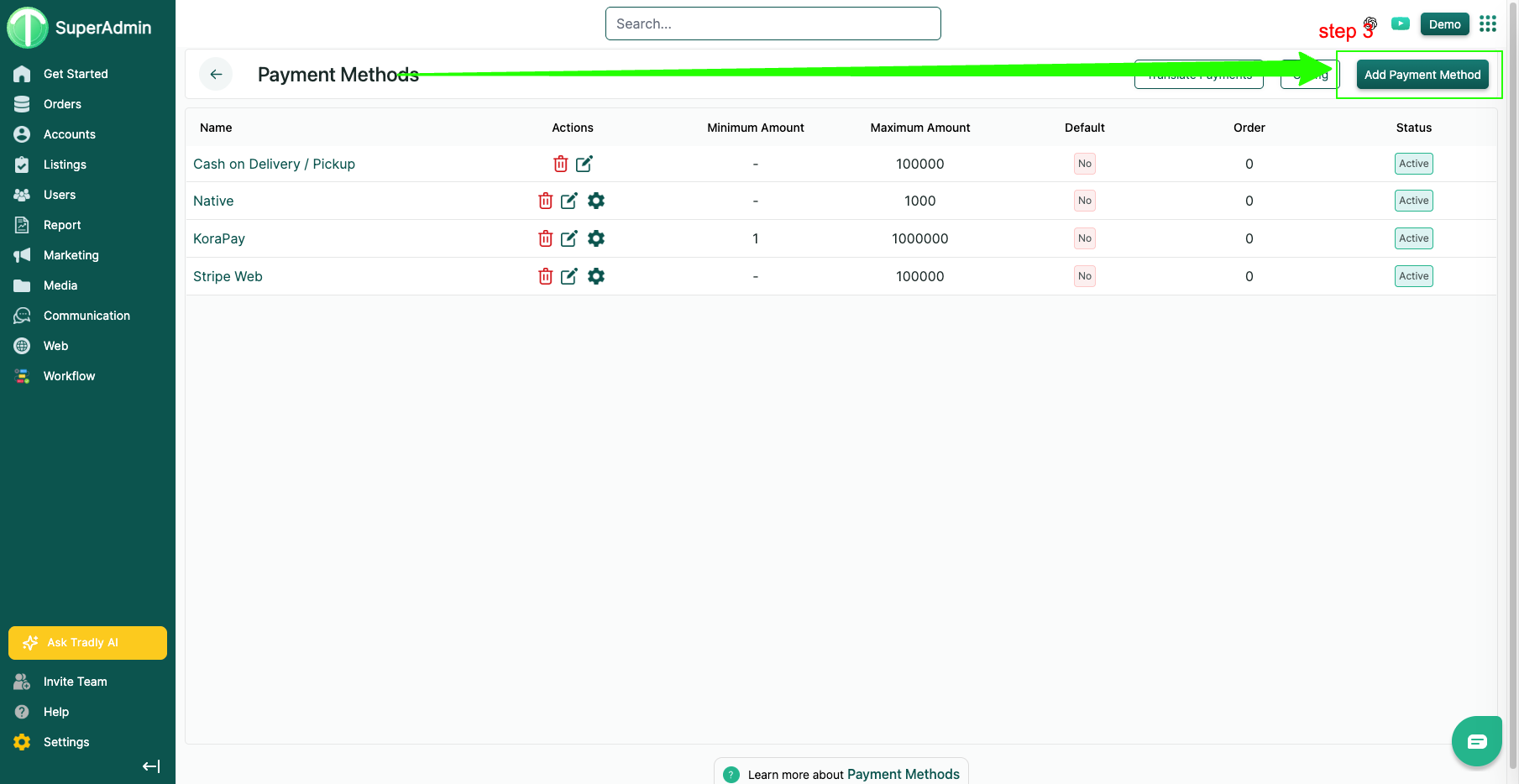

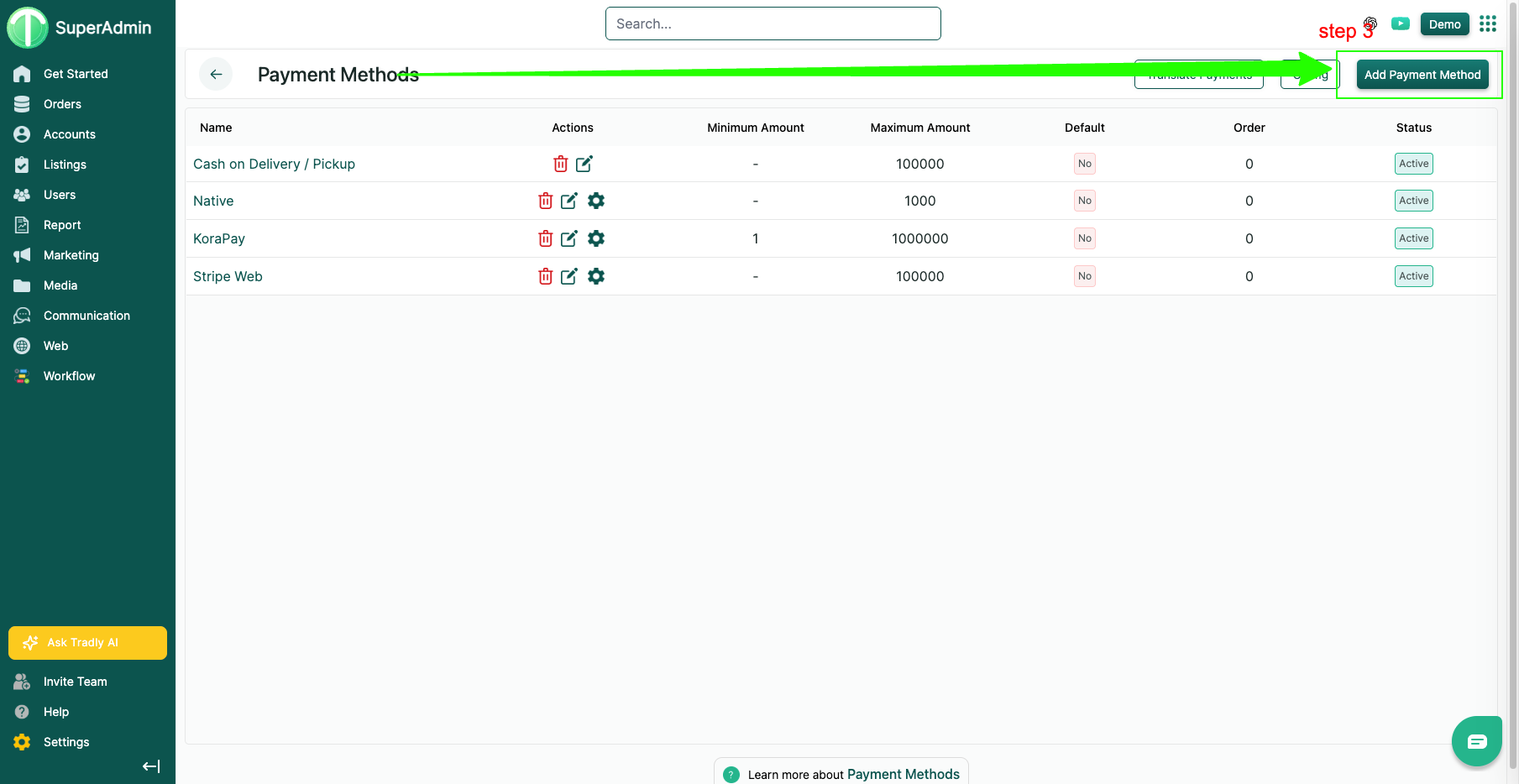

✅ Step 3 — Add Payment Method

Click Add Payment Method

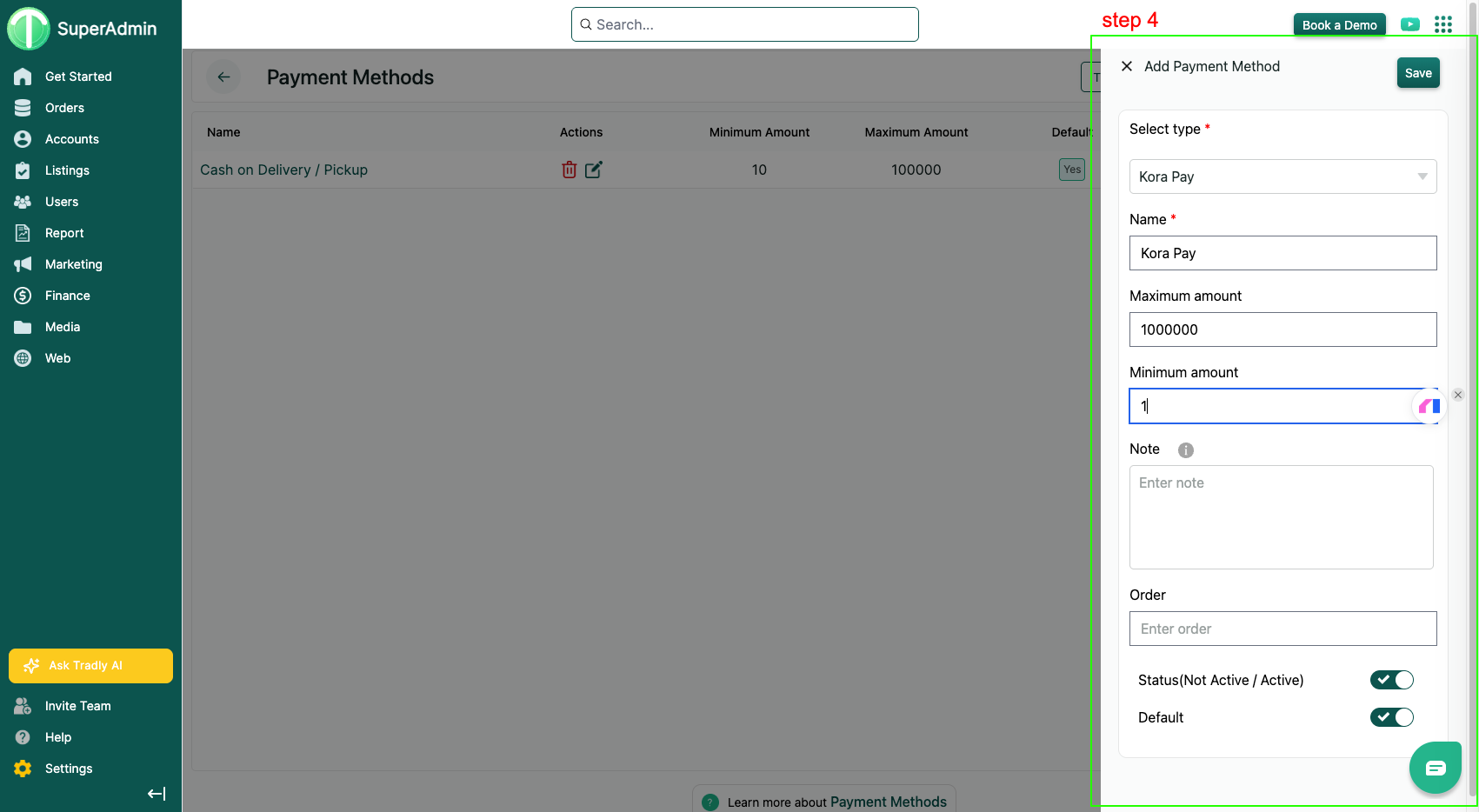

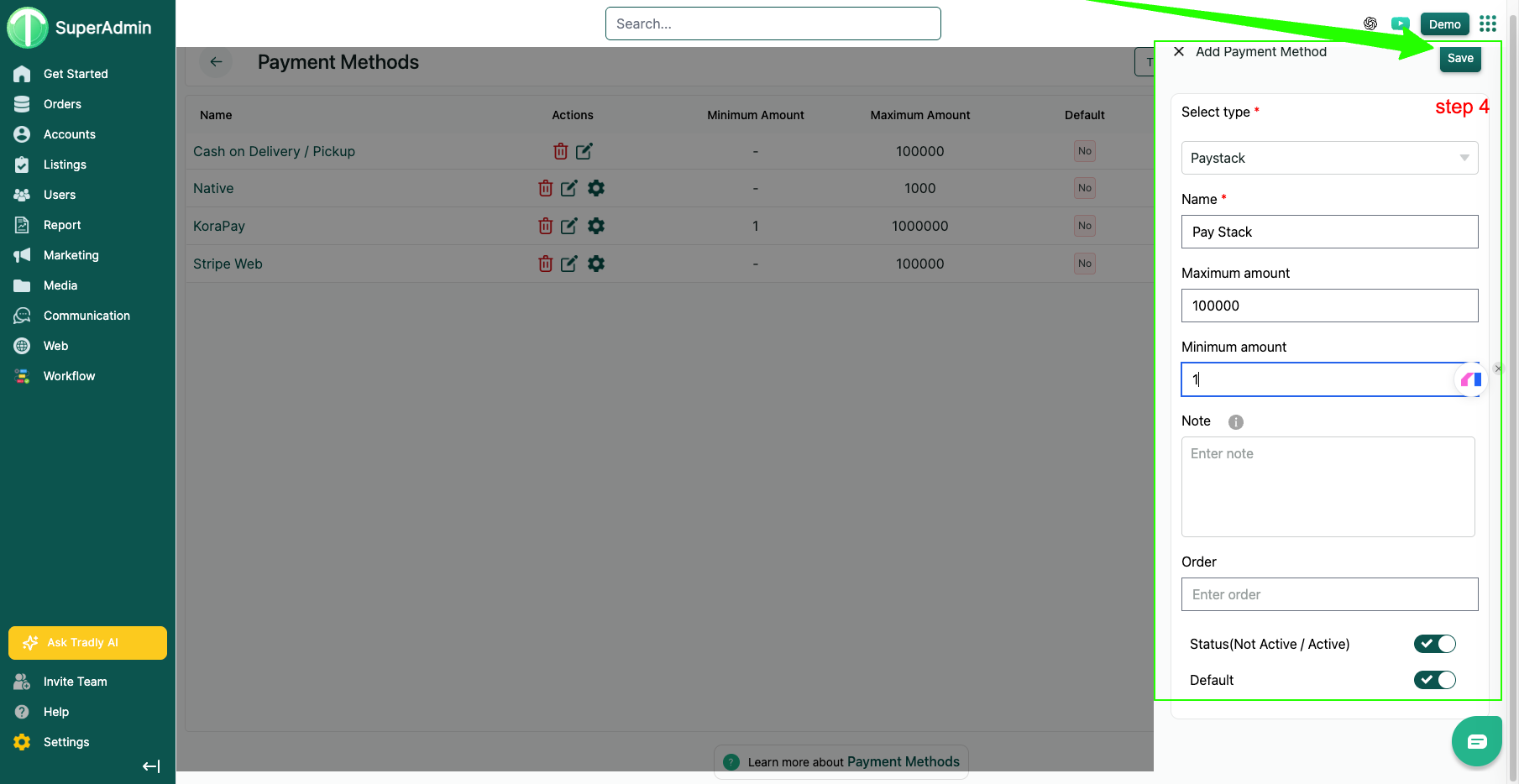

✅ Step 4 — Choose KoraPay

Fill in details:

Field | Description |

|---|---|

Select Type | Choose Kora Pay |

Name | Display name on checkout (e.g., KoraPay) |

Maximum Amount | (Optional) limit for payments |

Minimum Amount | (Optional) minimum payment allowed |

Status | Set to Active |

Default | Enable if KoraPay is your default method |

Hit Save

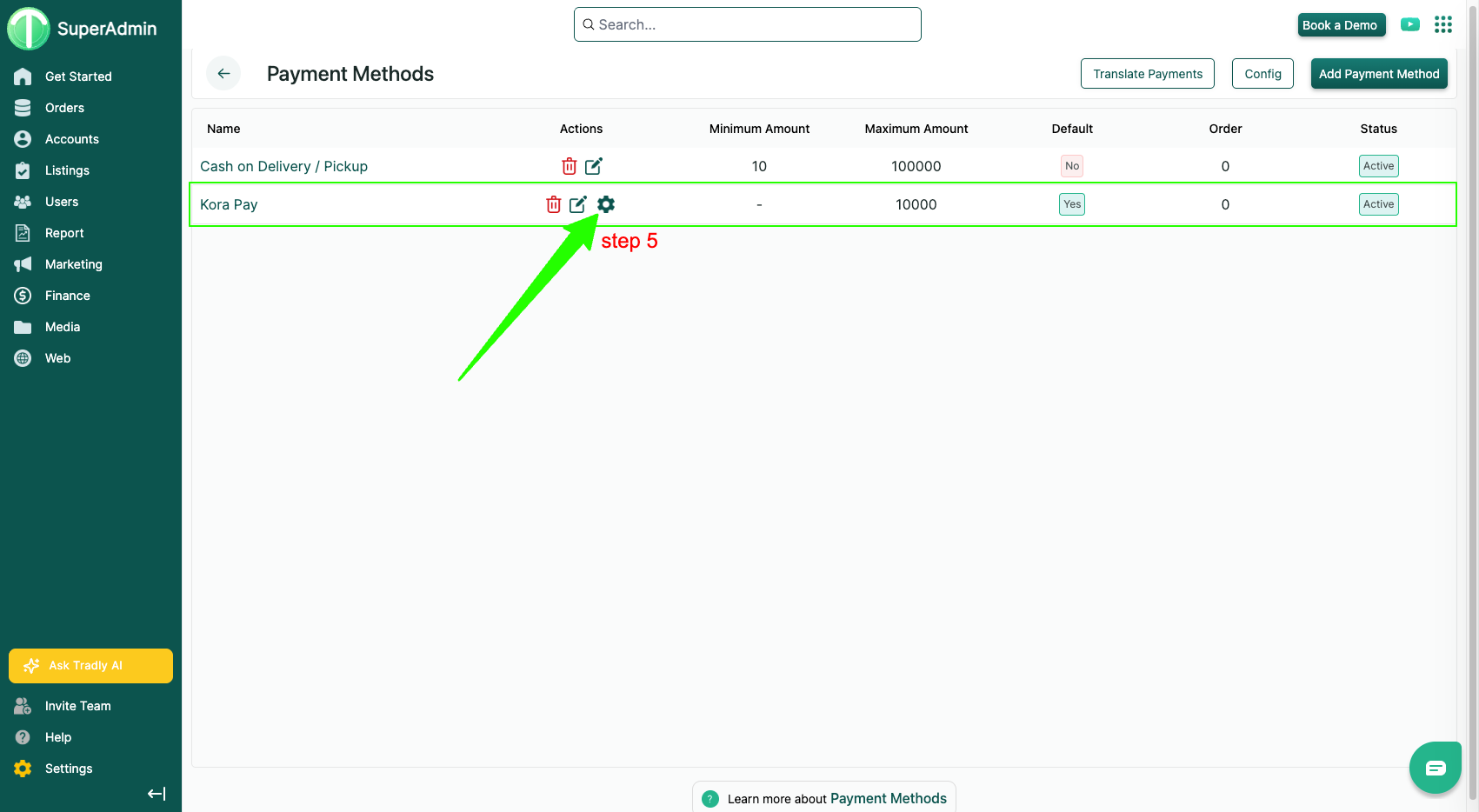

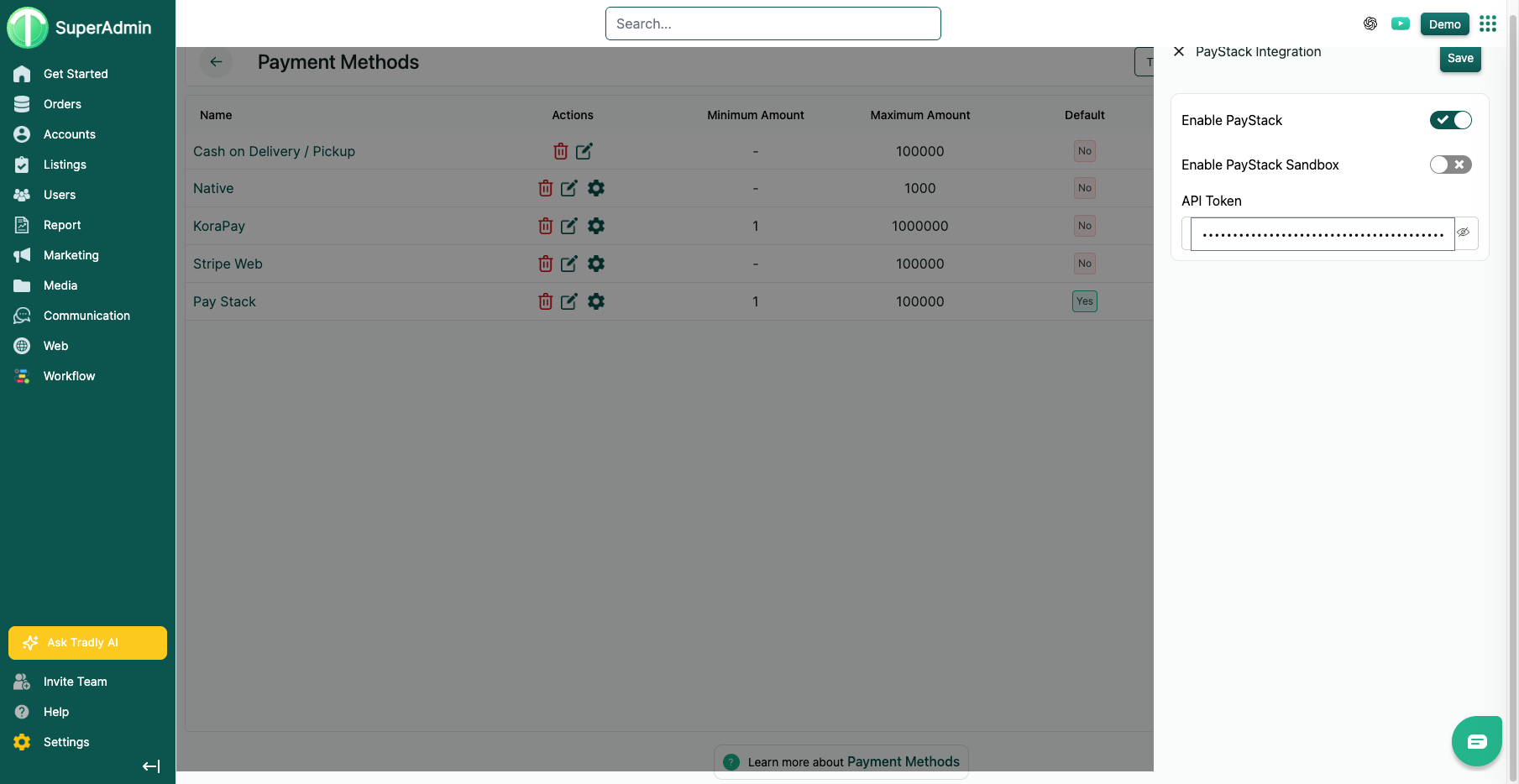

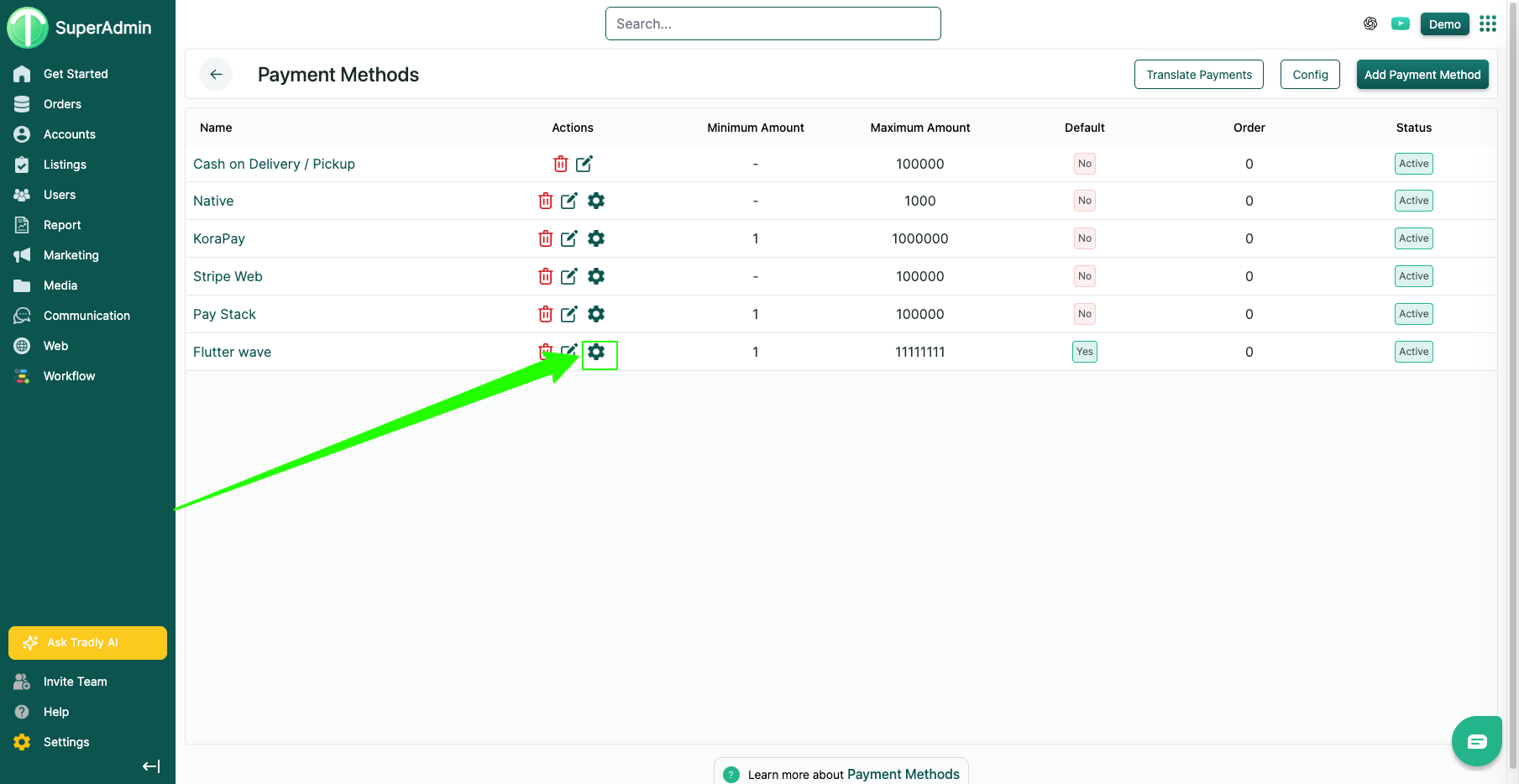

✅ Step 5 — Open Integration Settings

Click the Gear icon next to KoraPay

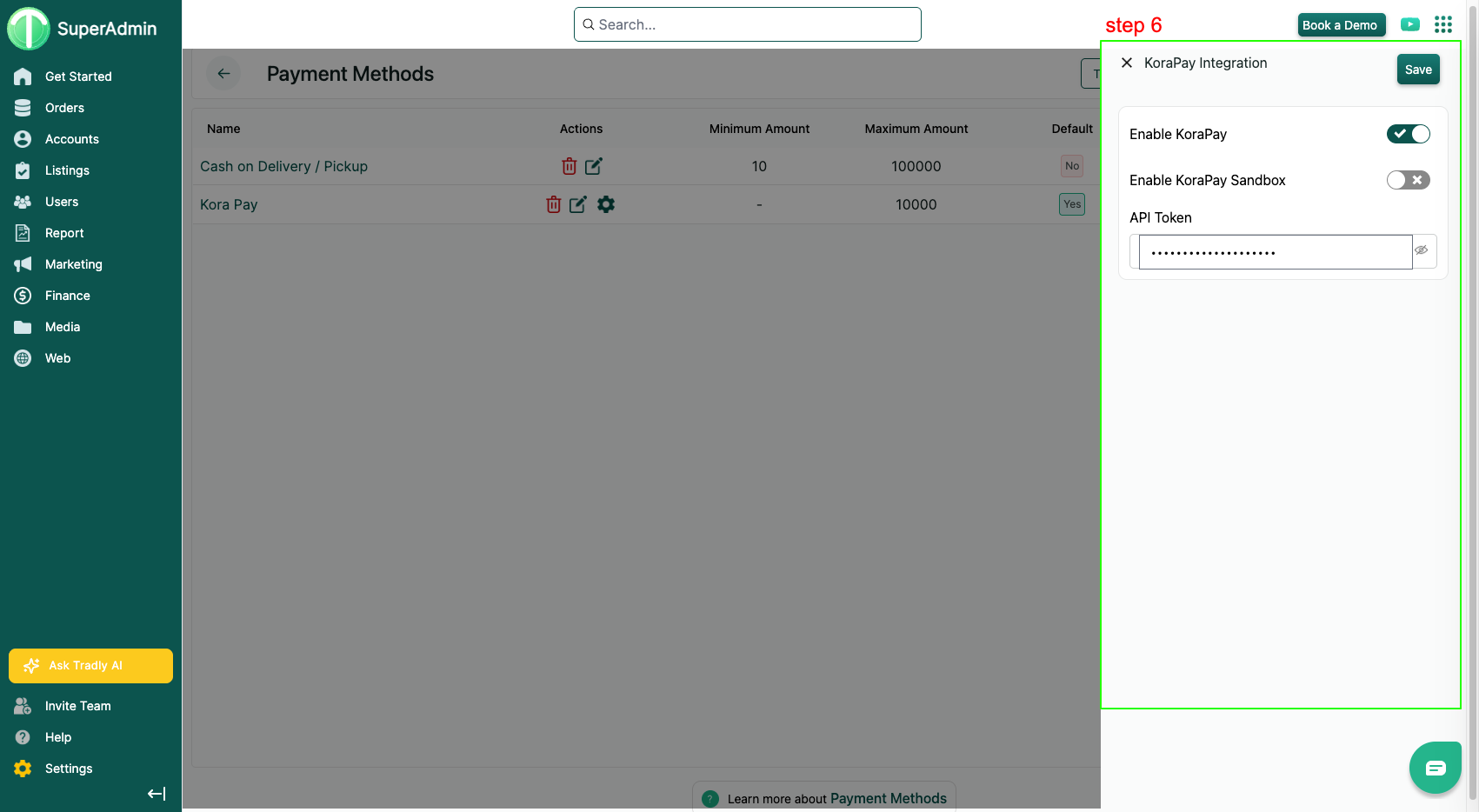

✅ Step 6 — Enter API Token

You will see:

Field | Description |

|---|---|

Enable KoraPay | Turn ON ✅ |

Enable Sandbox | Keep OFF (unless testing) |

API Token | Paste the Secret Key copied from KoraPay |

Click Save

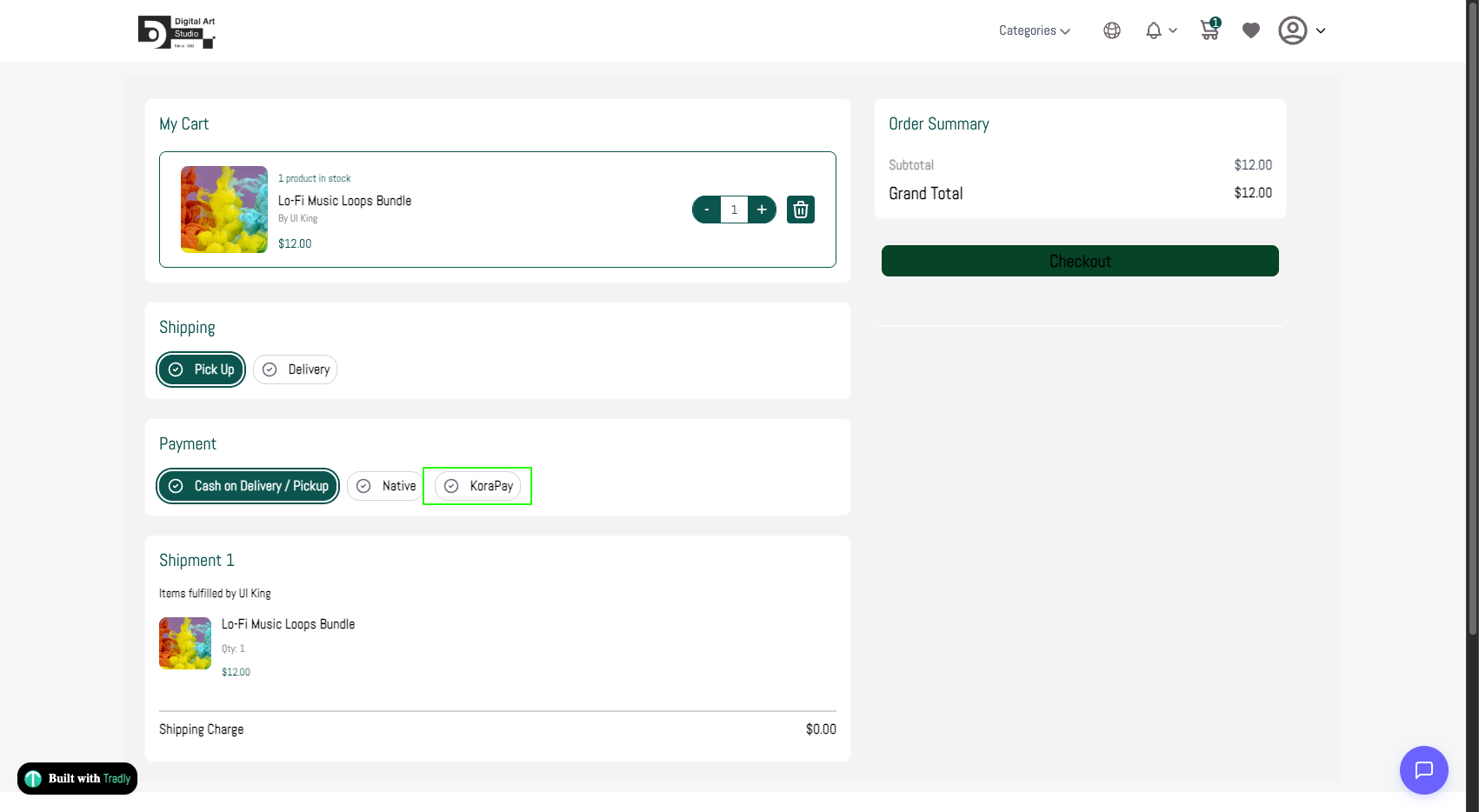

Customer Checkout Experience

Now users will see KoraPay as a payment option during checkout.

They select it → pay via KoraPay → order is created automatically.

Success!

You have successfully integrated KoraPay with your Tradly platform.

Next steps you may consider:

Enable Live Mode in KoraPay before going public

Test payments using a low amount first

Video Tutorial

For a complete walkthrough, watch the YouTube guide below:

Paystack

What is Paystack?

Paystack is a popular online payment gateway that allows African businesses to accept card payments, bank transfers, USSD, Apple Pay, Google Pay, and more.

Why use Paystack with Tradly?

Smooth online checkout experience

Automated payment verification

Multi-method African payment support

Secure, reliable & fast processing

Once connected, customers will be able to checkout using Paystack directly from your marketplace.

Availability: Paystack supports businesses in Nigeria, Ghana, Kenya, South Africa, and Côte d’Ivoire (with additional expansion planned across Africa). https://paystack.com/countries

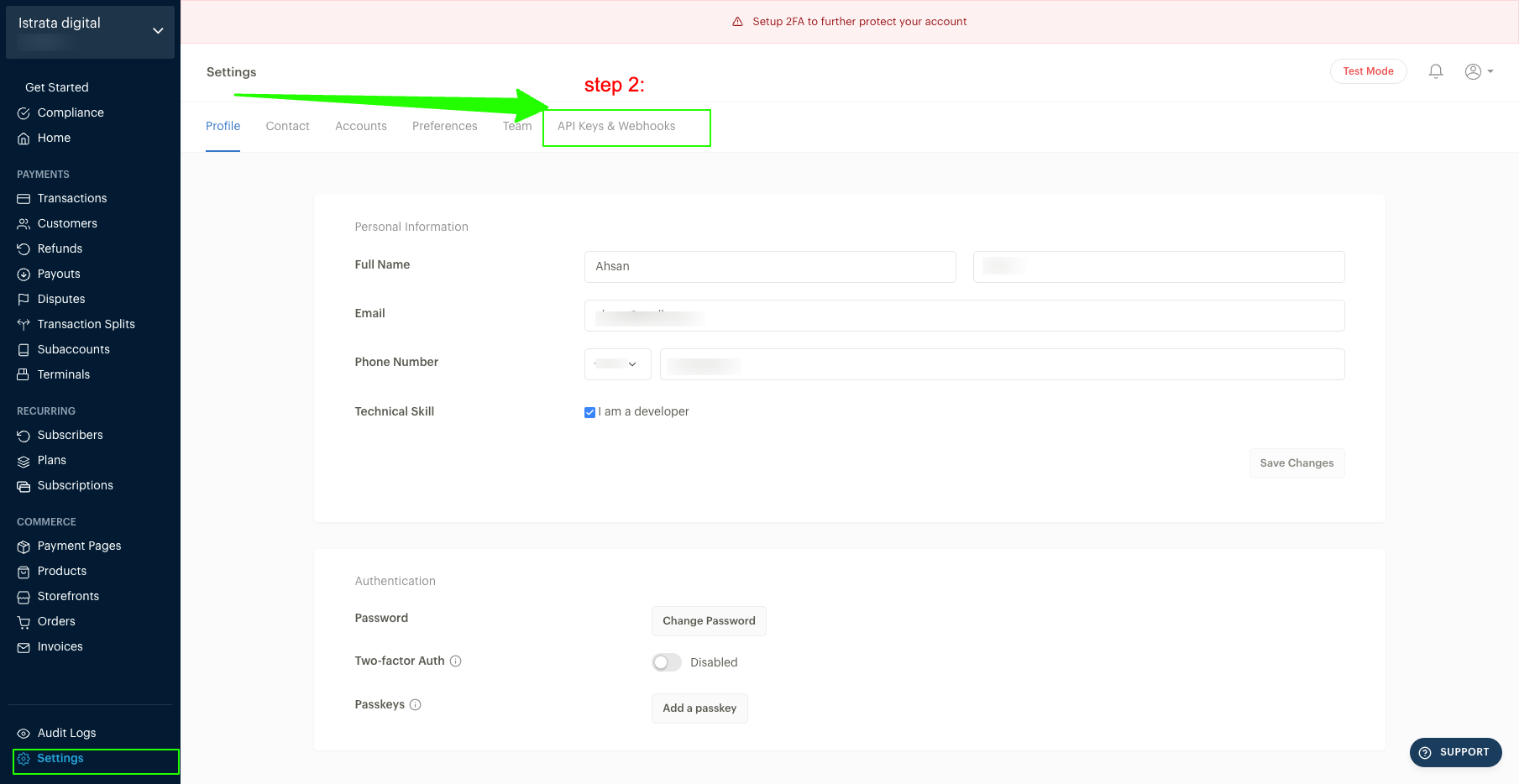

Part 1: Get Paystack API Keys

Step 1 — Open Paystack Dashboard

Go to: 🔗 https://dashboard.paystack.com/#/get-started

Click Settings on left menu

Step 2 — Go to API Keys

Menu path: Settings → API Keys & Webhooks OR

direct link: 🔗 https://dashboard.paystack.com/#/settings/developers

✅ Step 3 — Copy Your Secret Key

In the Test API Keys section, copy:

Key | Purpose |

|---|---|

Secret Key | Required for Tradly connection |

Public Key | Not needed for Tradly setup |

⚠️ Keep your Secret Key private

Do not use Test Key in Live mode

Part 2: Add Paystack in Tradly SuperAdmin

Step 1 — Log in to Tradly SuperAdmin

🔗 https://superadmin.tradly.app/

Go to Settings 🔗 https://superadmin.tradly.app/settings

Step 2 — Open Payment Settings

Settings → Payments

🔗 https://superadmin.tradly.app/payments

Step 3 — Click Add Payment Method

Step 4 — Fill Paystack Details

Field | Meaning |

|---|---|

Select Type | Choose Paystack |

Name | Display name (e.g., Paystack) |

Minimum Amount | Lowest allowed payment |

Maximum Amount | Highest allowed payment |

Status | Set to Active |

Default | Enable if Paystack is default |

Click Save

Step 5 — Add API Key

Click Settings (Gear Icon) beside Paystack

Fields to complete:

Field | Description |

|---|---|

Enable Paystack | Turn ON ✅ |

Enable Sandbox | If testing only |

API Token | Paste Paystack Secret Key |

Click Save

Testing Payments

If you’re testing in Sandbox Mode:

Use Paystack Test Secret Key

Enable Sandbox Mode in Tradly Paystack settings

When ready to go live:

Switch both accounts to Live Mode

Replace test key with Live Secret Key

📌 Notes & Tips

Tip | Why it matters |

|---|---|

Use Test mode first | Avoid real charges |

Keep Secret Key private | Prevent fraud |

Only one default gateway | Cleaner checkout |

Video Tutorial

For a complete walkthrough, watch the YouTube guide below:

Flutterwave

What is Flutterwave?

Flutterwave is a leading African payment gateway that enables businesses to accept online payments via cards, bank transfers, USSD, mobile money, and global wallets.

Availability

Flutterwave supports businesses in: Nigeria, Ghana, Kenya, Uganda, South Africa, Tanzania, Zambia, and several other African regions, with global payment support (USD, GBP, EUR) for international merchants.

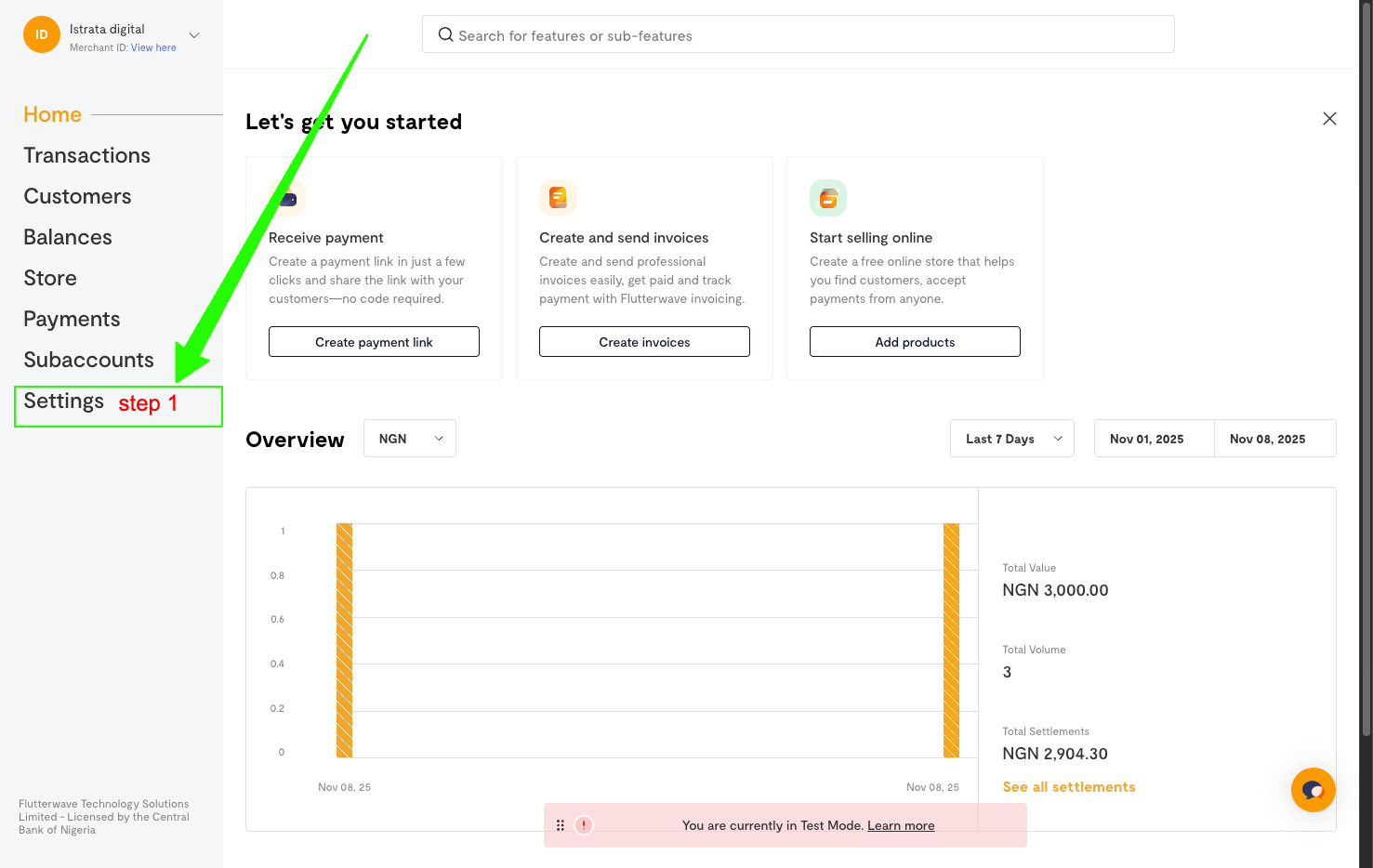

Part 1: Get Flutterwave API Keys

Step 1 — Open Flutterwave Dashboard

Go to Dashboard:

🔗 https://app.flutterwave.com/dashboard/home

From the left menu, click Settings

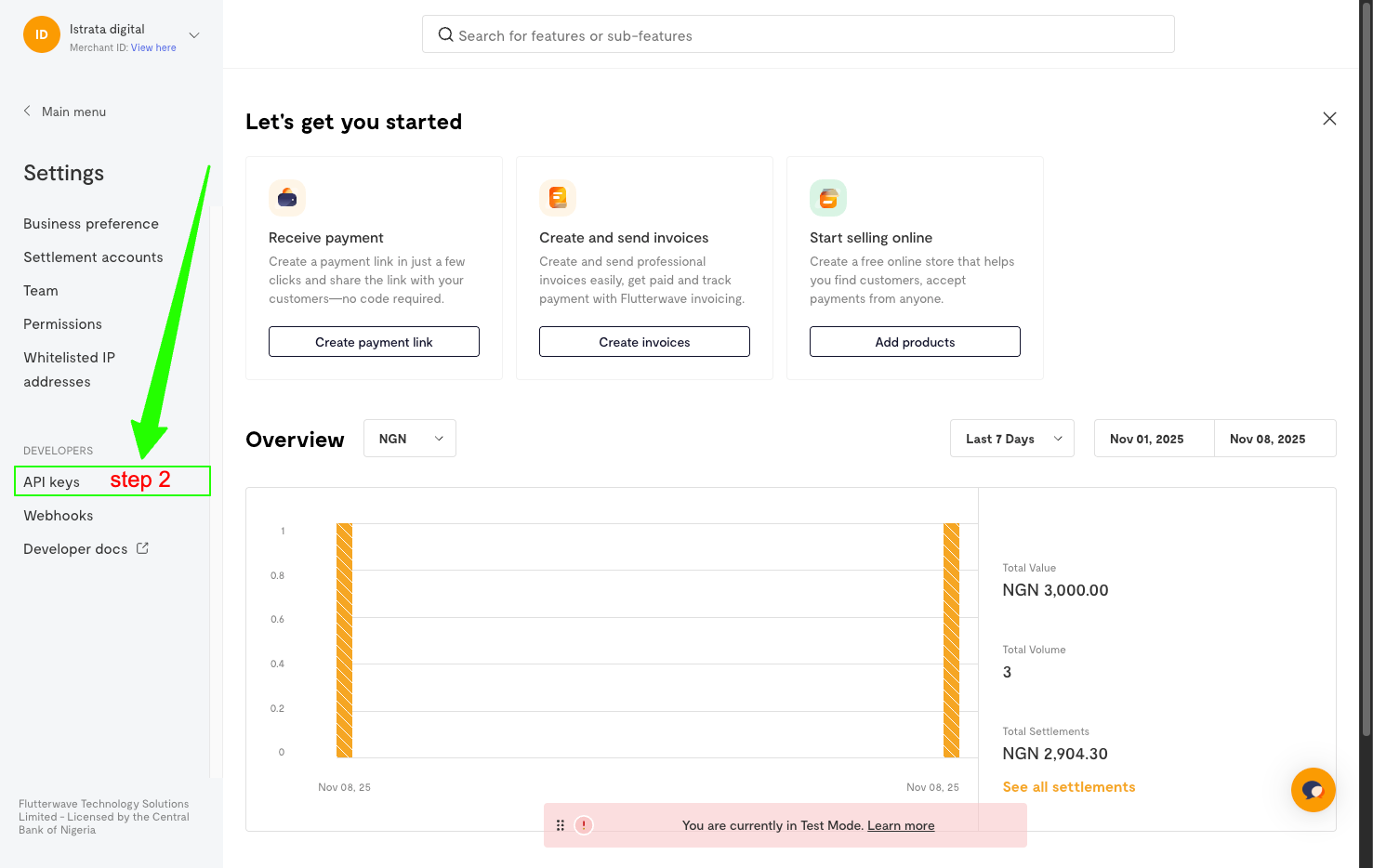

Step 2 — Go to API Keys Page

Navigate to: Settings → API Keys

Direct link to Live API page: 🔗 https://app.flutterwave.com/dashboard/settings/apis/live

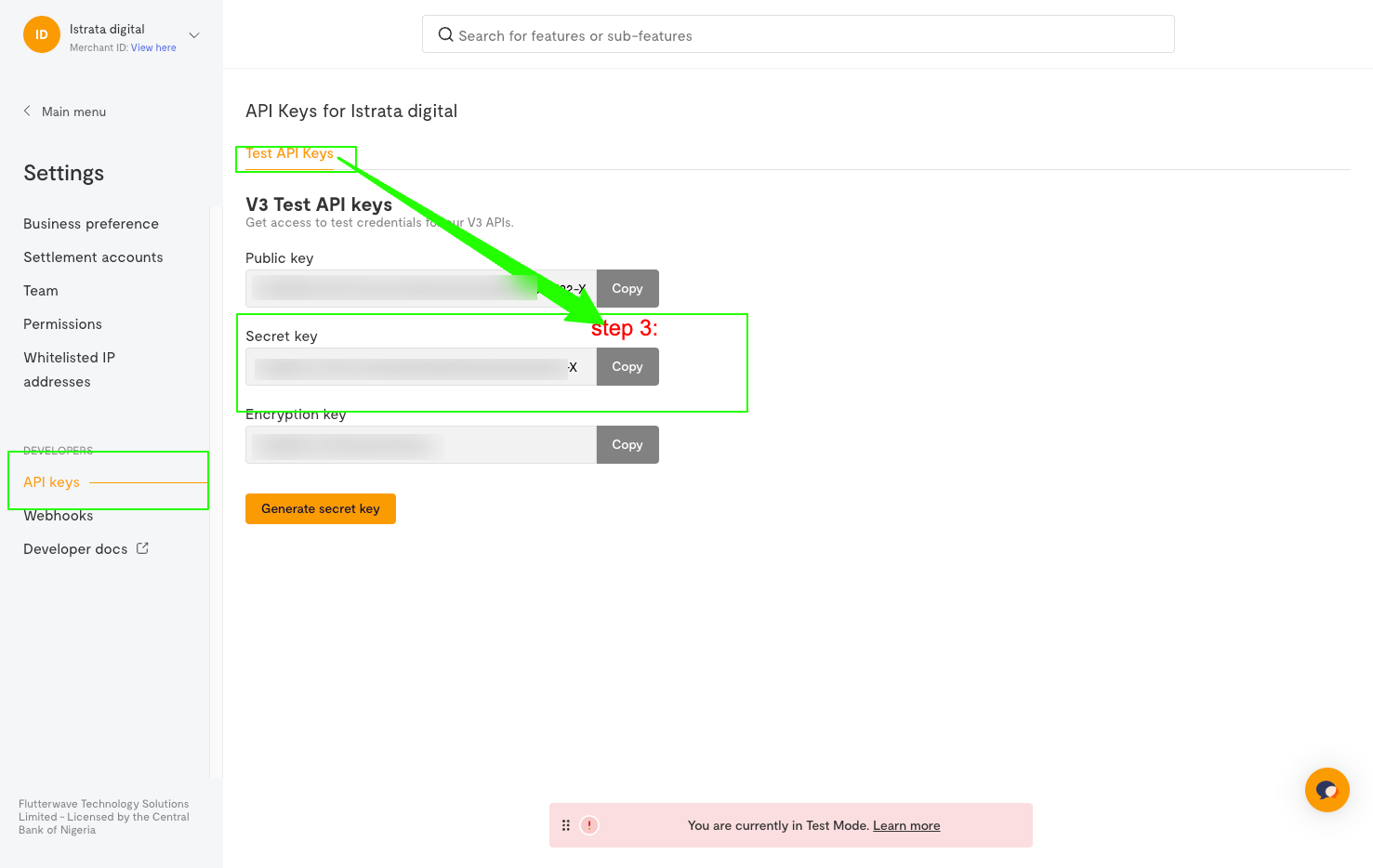

Step 3 — Copy Your API Secret Key

You will see your keys under Live API Keys

Key | Use |

|---|---|

Secret Key | Required for Tradly setup |

Public Key | Only needed for client-side apps |

Encryption Key | (Not required for Tradly setup) |

Click Copy next to Secret Key

⚠️ Keep this key private.

Test mode keys are separate — do not mix them with Live mode.

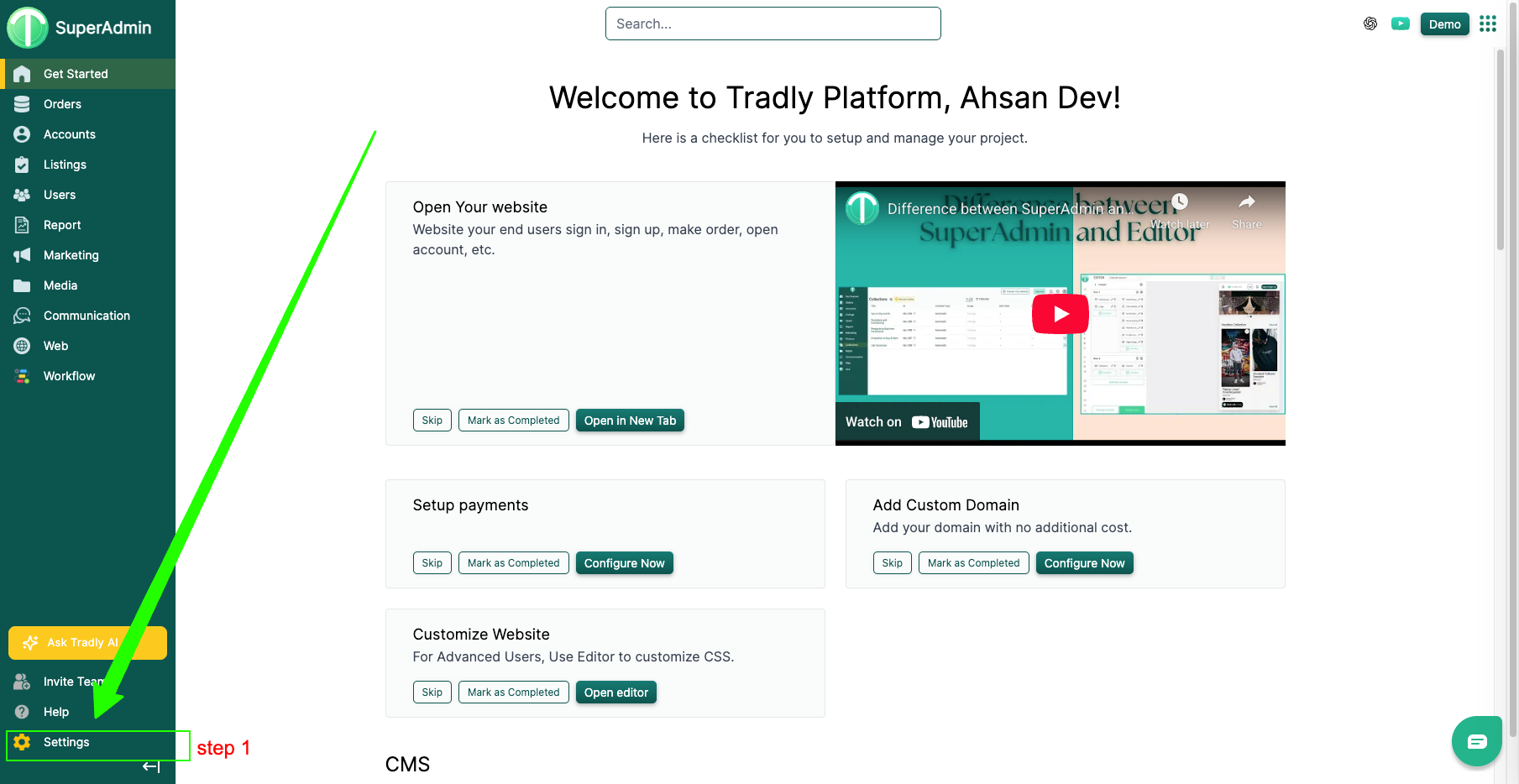

Part 2: Add Flutterwave in Tradly SuperAdmin

Step 1 — Open Tradly SuperAdmin

🔗 https://superadmin.tradly.app/

Go to Settings: https://superadmin.tradly.app/settings

Step 2 — Open Payment Methods

Settings → Payments https://superadmin.tradly.app/payments

Step 3 — Click Add Payment Method

Step 4 — Fill in Flutterwave Details

Field | Description |

|---|---|

Select Type | Choose Flutterwave |

Name | Display name (e.g., Flutterwave) |

Minimum Amount | Optional |

Maximum Amount | Optional |

Status | Set to Active |

Default | Enable if Flutterwave is your main payment option |

Click Save

-FCVaQjDD.png)

Step 5 — Paste API Key

Click the Settings/Gear icon next to Flutterwave method

Enter:

Field | Description |

|---|---|

Enable Flutterwave | On ✅ |

Sandbox Mode | Enable only if testing |

API Token | Paste Flutterwave Secret Key |

Save changes ✅

-HlXCTB38.png)

Test Before Going Live

If testing payments:

Use Flutterwave Test API Keys

Enable Sandbox Mode in Tradly settings

When launching:

Switch Flutterwave dashboard to Live

Replace test key with Live Secret Key

Disable Sandbox Mode in Tradly

Notes

Rule | Why |

|---|---|

Use correct mode keys | Test vs Live keys are different |

Never share secret key | Protects your business |

Enable only one default payment method | Cleanest checkout UX |

Video Tutorial

For a complete walkthrough, watch the YouTube guide below:

Checkout.com

What is Checkout.com?

Checkout.com is a global payment platform used by leading companies worldwide. It supports card payments, digital wallets, international currencies, 3D Secure, fraud detection, and provides one of the most reliable processing infrastructures.

Where Checkout .com Works

Checkout .com supports merchants in over 50+ countries, including the UK, EU, US, Australia, Middle East, and Asia-Pacific. For most African markets, onboarding may require additional verification.

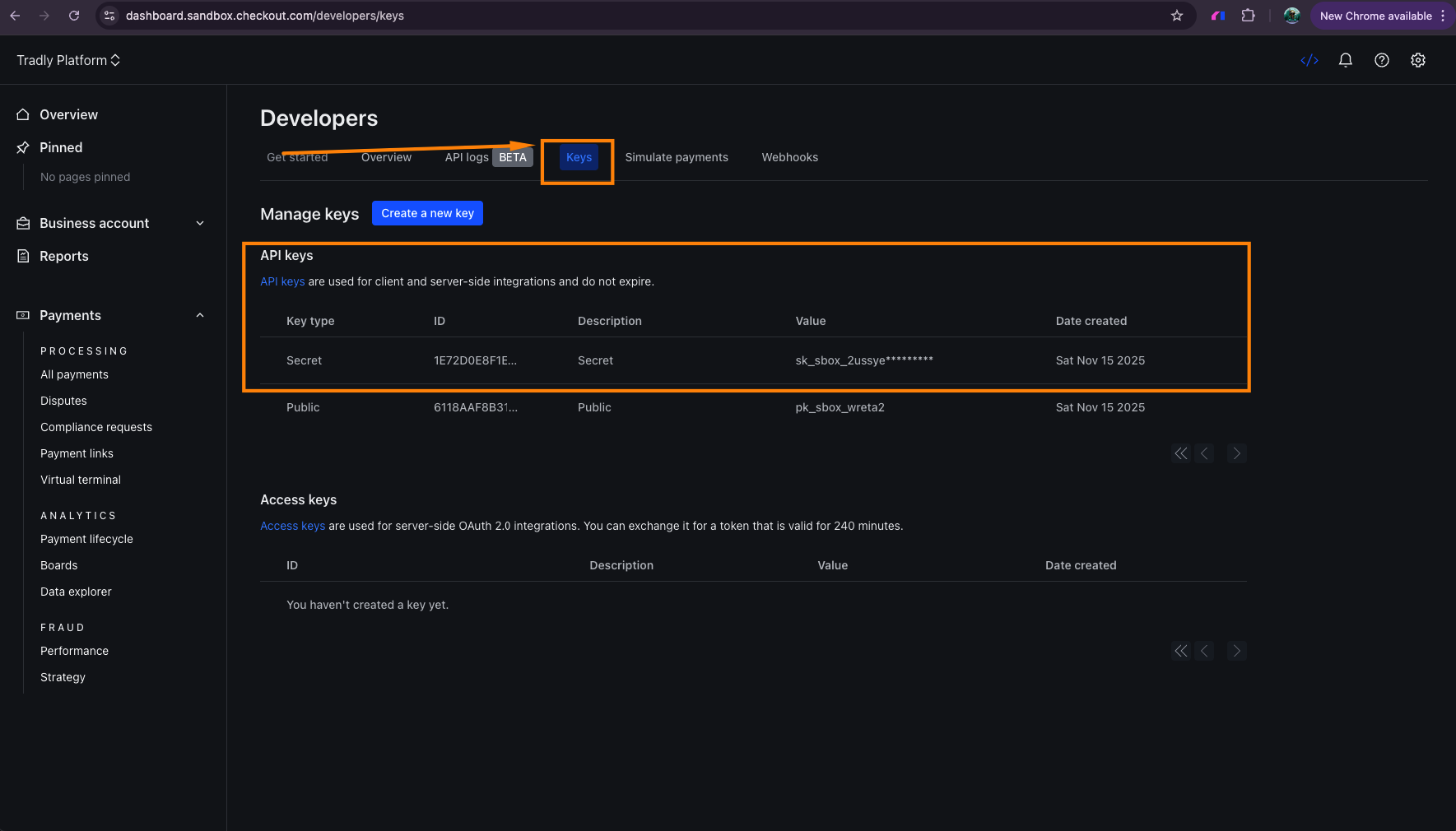

Part 1: Get Your Checkout.com API Keys

URLs You Need

Dashboard Home:

Developer Setup Guide:

https://dashboard.sandbox.checkout.com/developers/get-started

API Keys Page:

https://dashboard.sandbox.checkout.com/developers/keys/1E72D0E8F1EC6B8DD29A805C4F908395

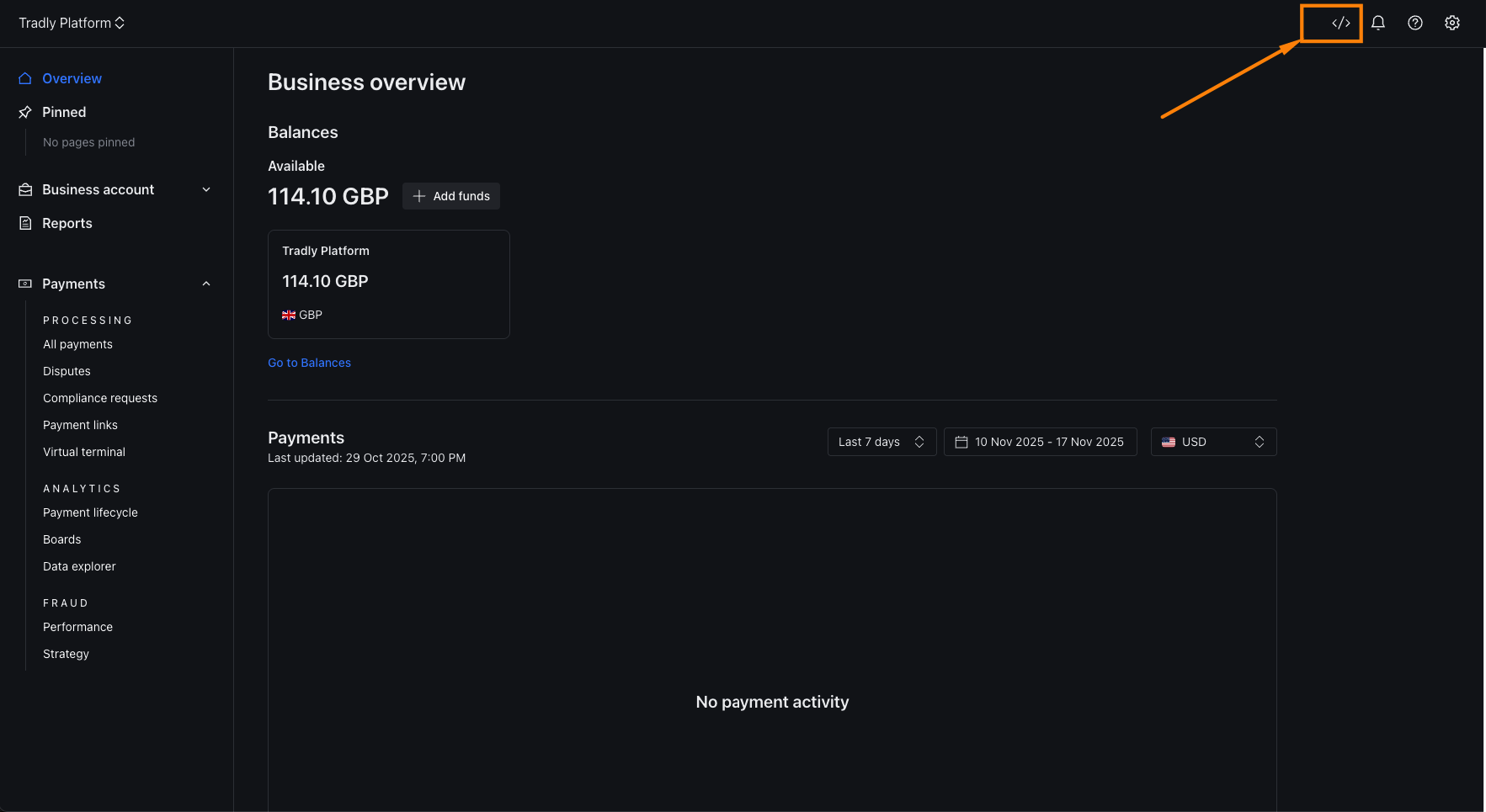

Step 1 — Open the Developer Section

Click the Developer icon (</>) from the top navigation bar.

This takes you to the Developers area.

Step 2 — Go to “Keys”

Select Keys from the developer tabs.

Here you will find your API Keys.

Step 3 — Copy the API Keys

Under API Keys, you will see:

Key Type | Purpose |

|---|---|

Secret Key | Required for Tradly server-side verification |

Public Key | Not required for Tradly |

Access Keys | Used only for OAuth; not needed here |

Copy the Secret Key.

⚠️ Never share your Secret Key publicly.

Use Sandbox Secret Key for testing & Live Secret Key when your platform goes live.

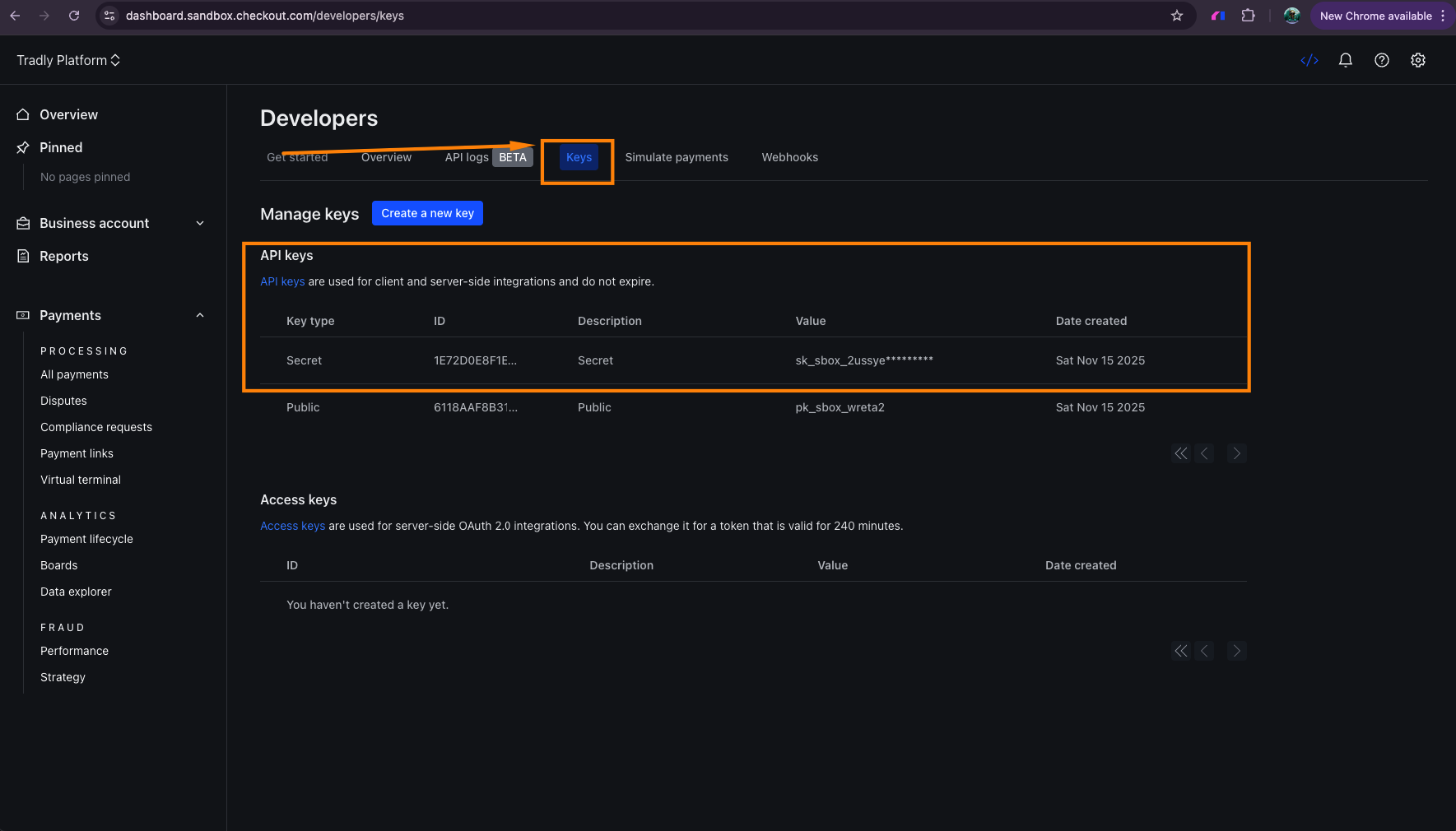

Step 4 — Copy the “Processing Channel ID”

Click on the Secret Key to open its details.

You will see:

Selected Processing Channels → Channel 1 (ID: pc_xxxxxxxxxxxxxxxxx)

This Processing Channel ID must be added inside Tradly.

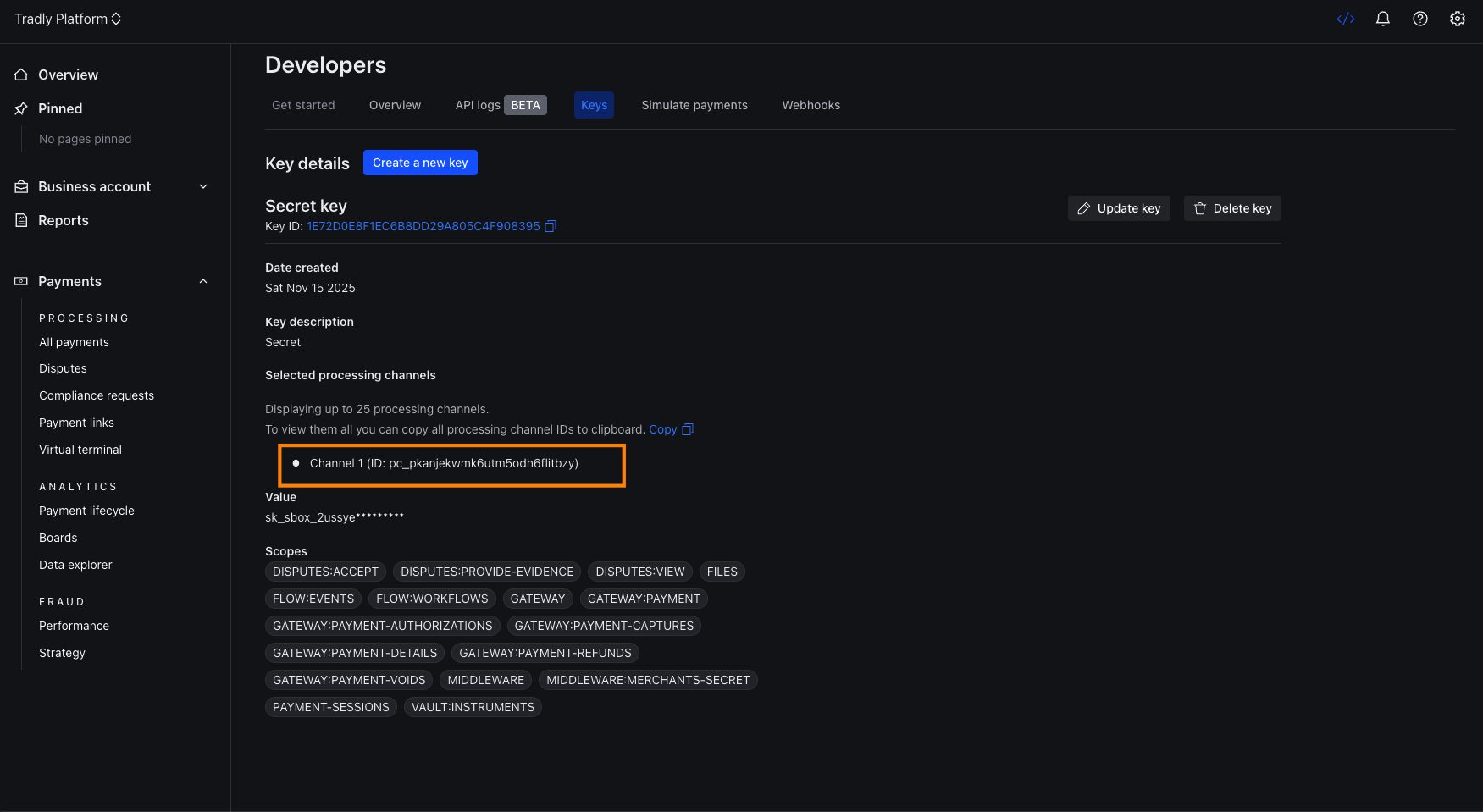

Part 2: Configure Checkout.com Inside Tradly SuperAdmin

URLs You Need

Tradly SuperAdmin:

Settings Page:

Payment Methods Page:

Step 1 — Open Settings

Left menu → Settings

Step 2 — Go to Payments

Settings → Payments

Step 3 — Add Payment Method

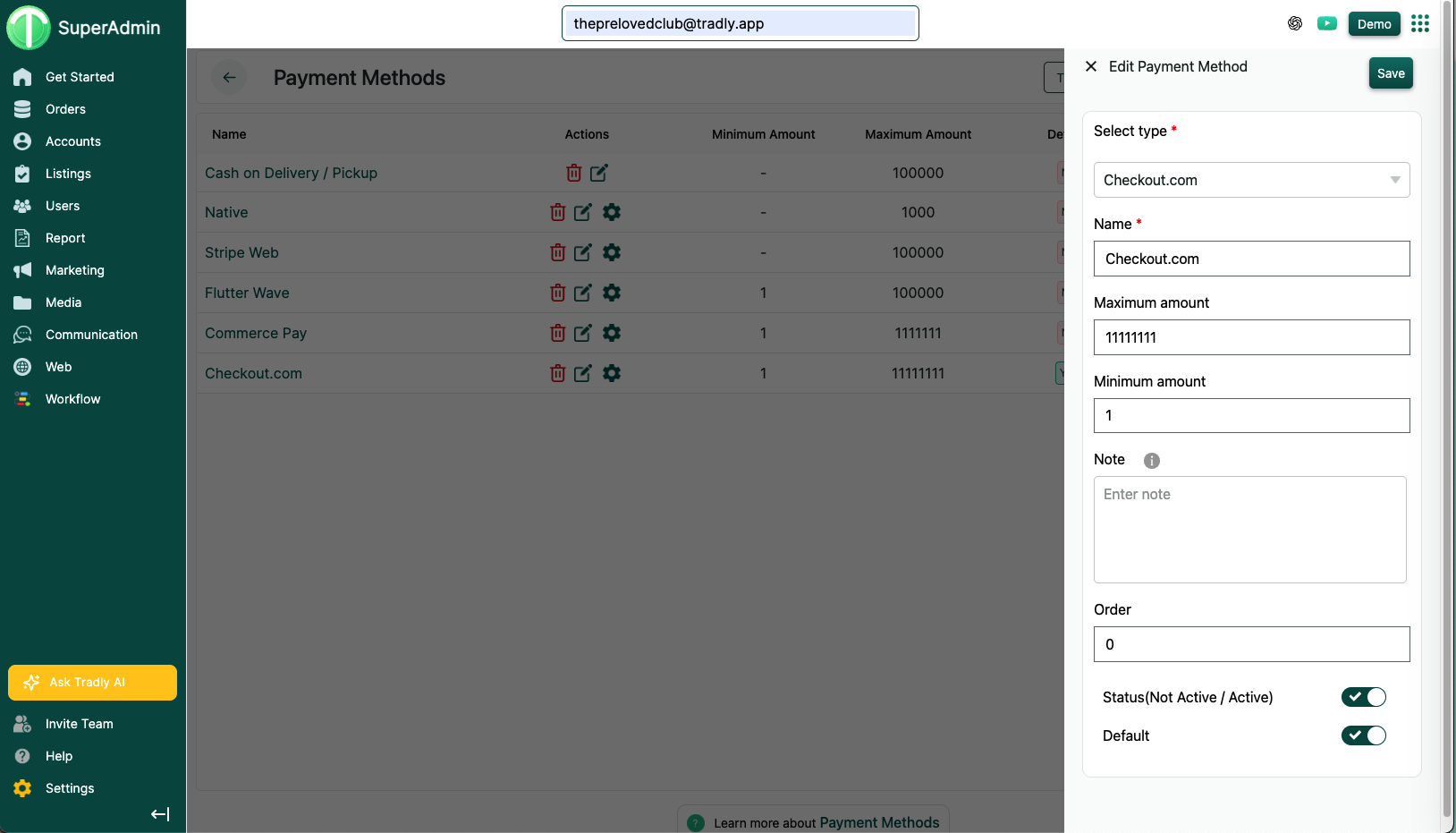

Click Add Payment Method Choose:

Field | Value |

|---|---|

Select Type | |

Name | “Checkout.com” or your preferred name |

Minimum Amount | Optional |

Maximum Amount | Optional |

Status | Active |

Default | If you want it as your main payment method |

Click Save

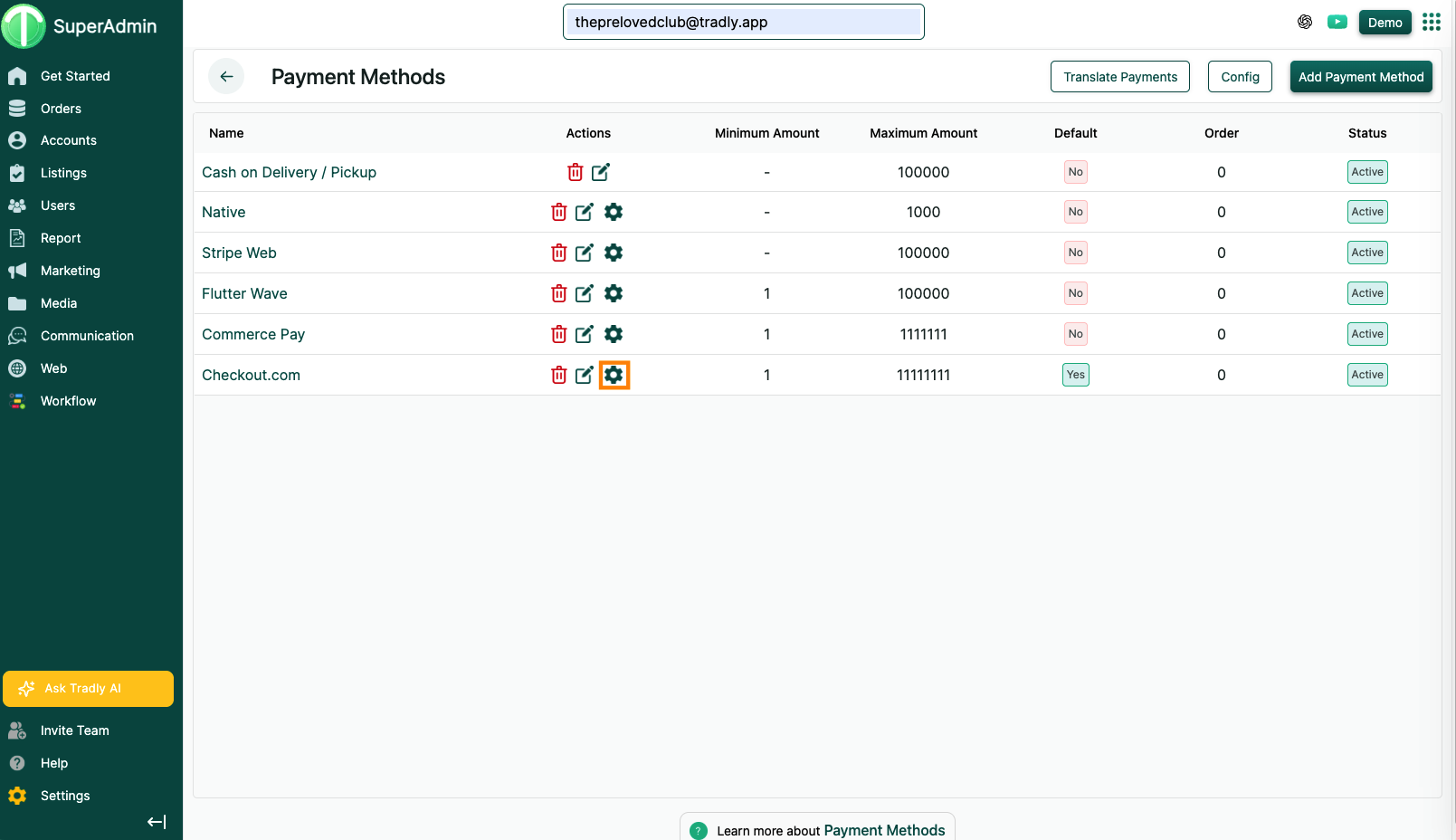

Step 4 — Open Integration Settings

Click the Gear Icon next to Checkout.com

This opens the Checkout.com configuration popup.

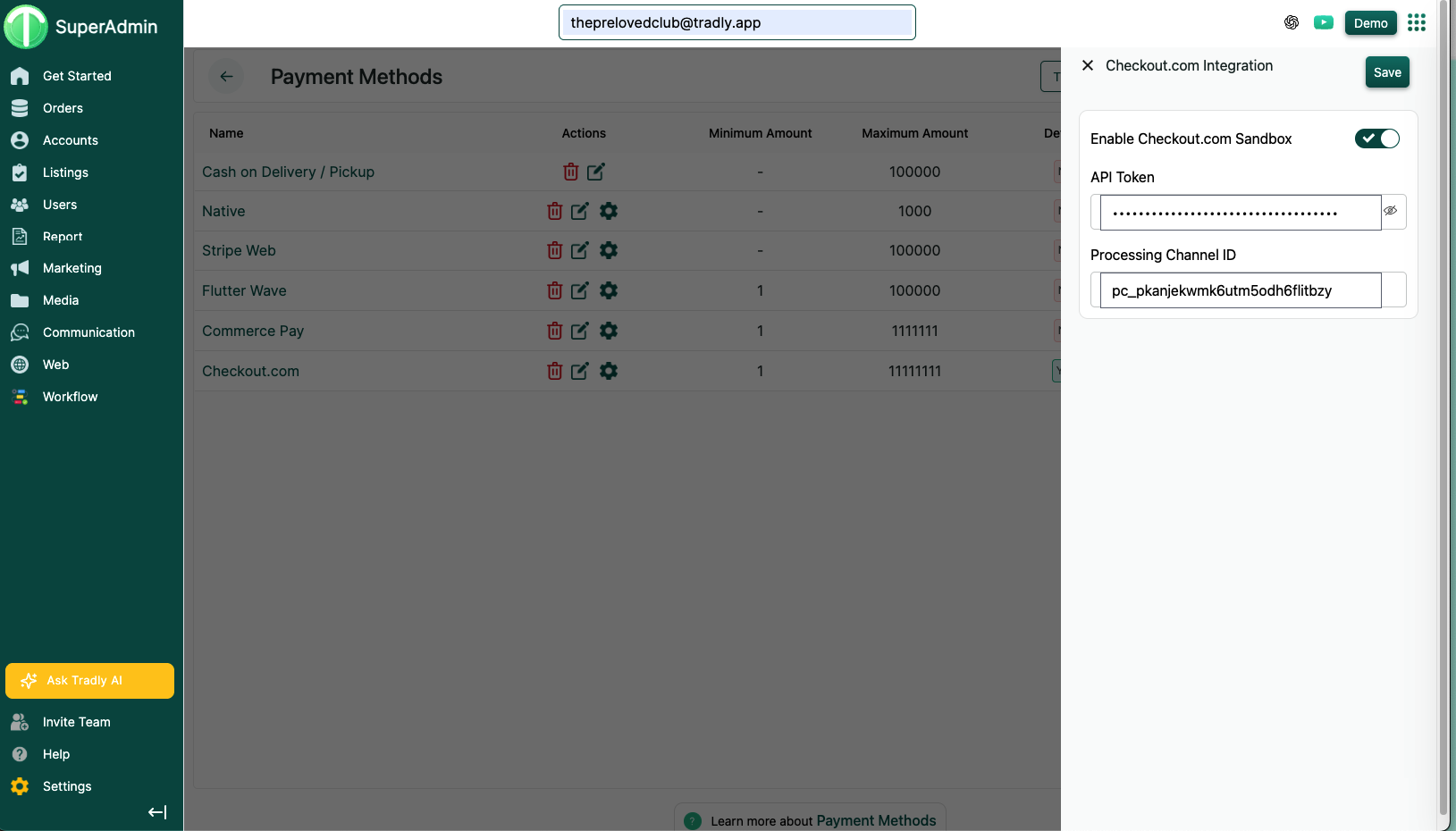

Step 5 — Enter Credentials

Inside the Checkout.com configuration:

Field | Description |

|---|---|

Enable Checkout.com | Turn ON |

Enable Sandbox | Use for testing only |

API Token | Paste your Secret API Key |

Processing Channel ID | Paste the pc_XXXXXXXXXXXX ID |

Click Save.

For Testing:

Use Sandbox Secret Key

Enable Sandbox Mode in Tradly Checkout.com settings

Use Checkout.com’s test card numbers

For Live:

Switch to Live Mode in Checkout.com dashboard

Replace API Token with Live Secret Key

Replace Processing Channel ID with Live Channel

Disable Sandbox Mode in Tradly

Video Tutorial

For a complete walkthrough, watch the YouTube guide below

CommercePay

What is CommercePay?

CommercePay is a Malaysia-based payment gateway designed for local businesses. It supports FPX bank payments, card payments, payout settlement, and merchant-specific payment handling.

Where CommercePay Works

CommercePay currently services Malaysia (MY) and is optimized for:

Malaysian bank payments (FPX)

MYR (Malaysian Ringgit)

Local merchant onboarding

Part 1: Get Your CommercePay Credentials

To connect CommercePay with your Tradly marketplace, you’ll need two things:

Merchant ID

Secret Key / API Key

Both values are available inside your CommercePay Merchant Portal.

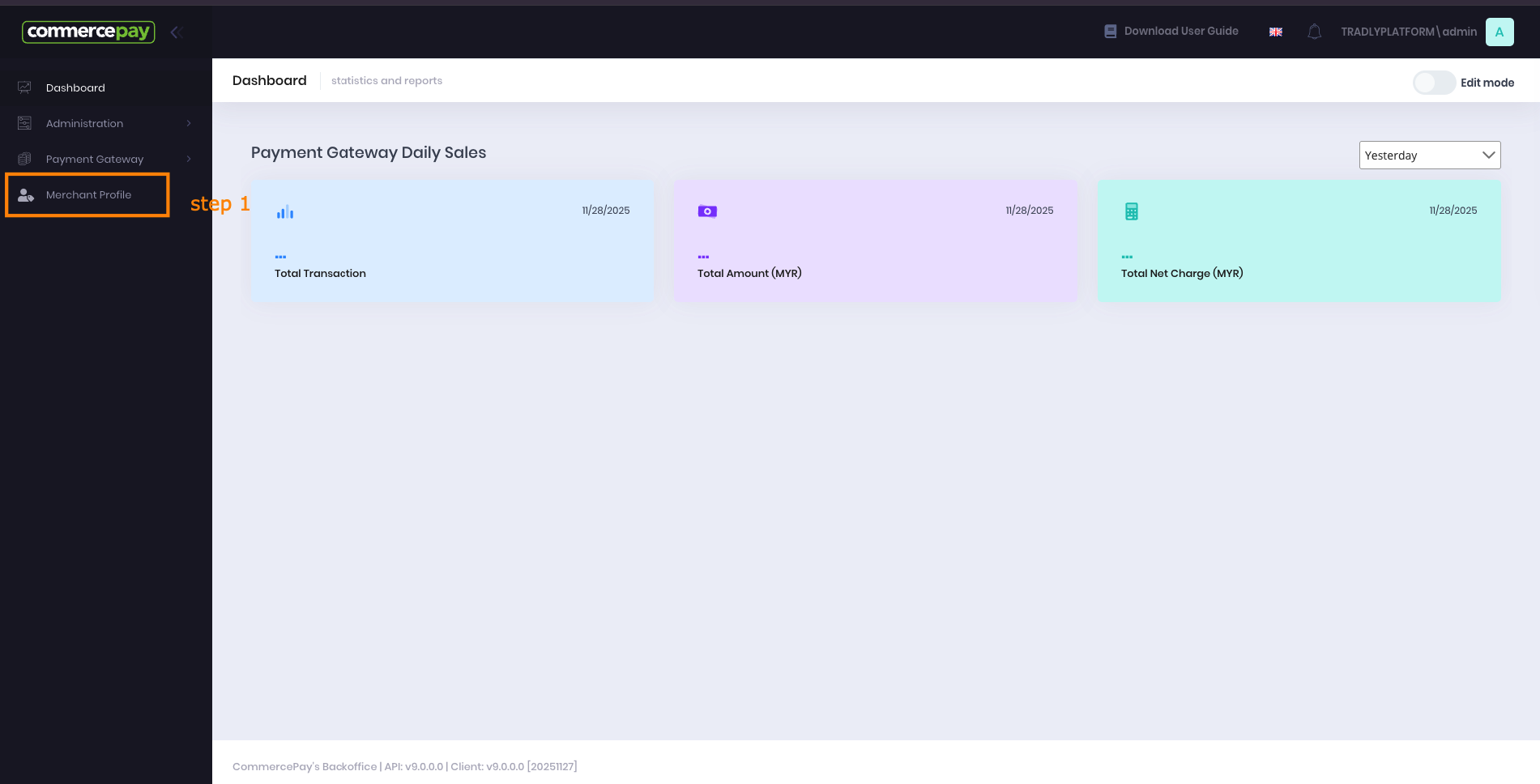

Step 1 — Open Merchant Profile

From the left sidebar, click: Merchant Profile

This page contains all your merchant configuration data.

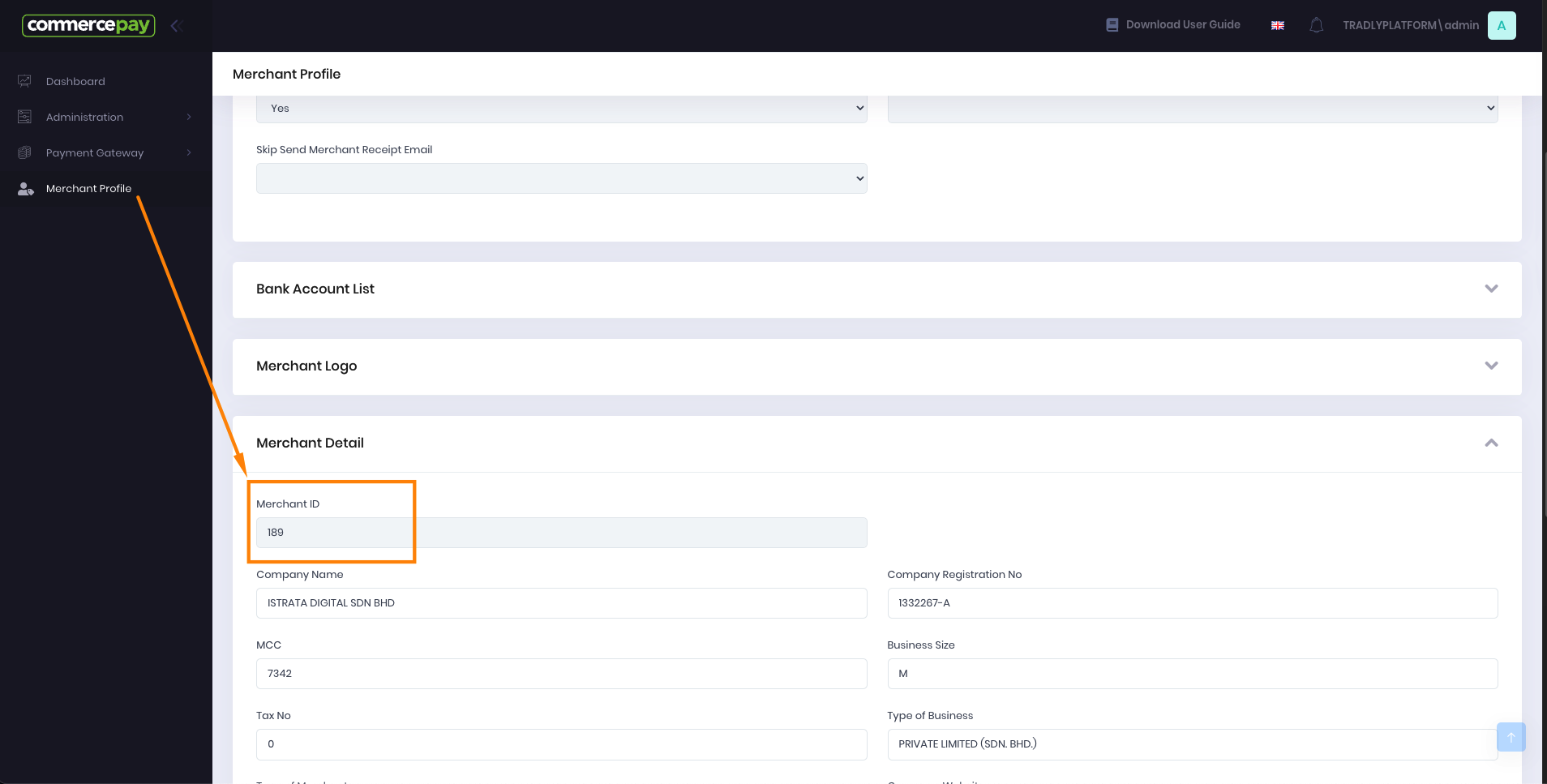

Step 2 — Copy Your Merchant ID

Scroll to Merchant Detail section. Here you will find:

Merchant ID: 189 (example)

This Merchant ID identifies your business inside CommercePay.

You must add this into Tradly.

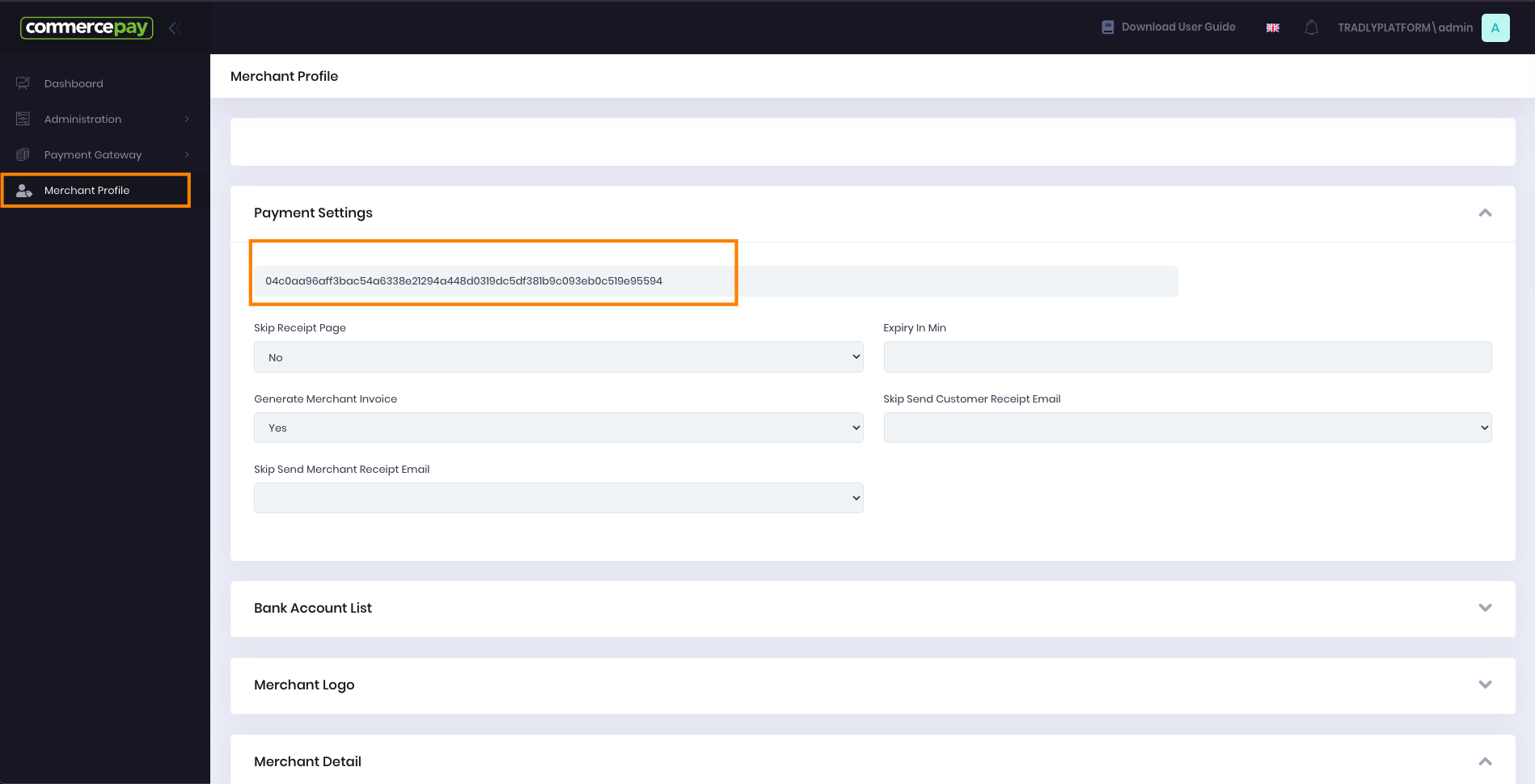

Step 3 — Copy the Secret Key

Scroll to the Payment Settings section.

You will see a long secret key string, for example:

04c0aa96aff3abc54a6338e21294a448d0111111155667793eb0c5f9e95594

This Secret Key is required for API authentication between Tradly and CommercePay.

⚠️ Keep this key private and never share publicly.

Part 2: Configure CommercePay in Tradly SuperAdmin

URLs you will need

Tradly SuperAdmin: https://superadmin.tradly.app

Settings: https://superadmin.tradly.app/settings

Payments: https://superadmin.tradly.app/payments

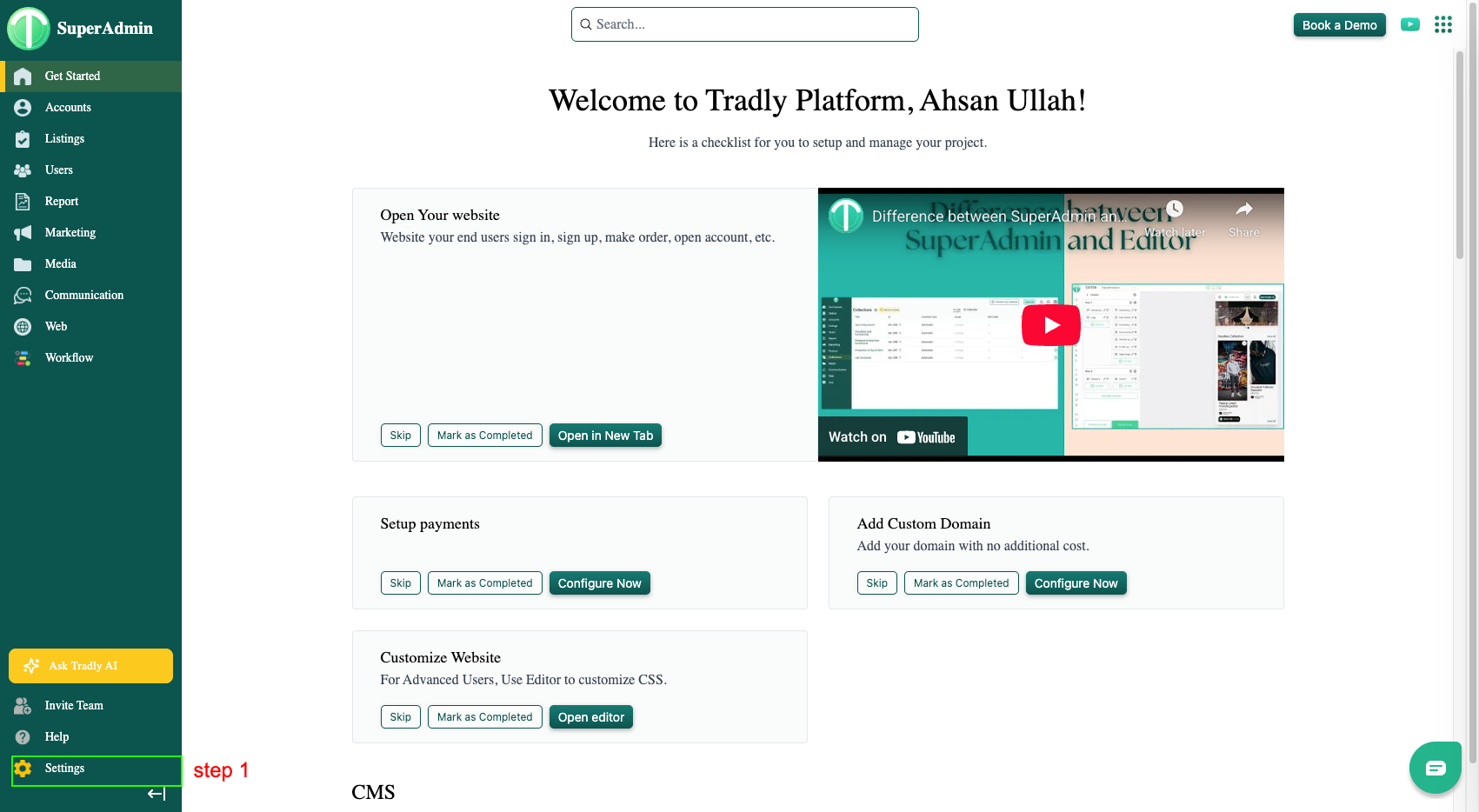

Step 1 — Open Settings

In the left menu → click Settings

Step 2 — Go to Payments

Settings → Payments

Step 3 — Add Payment Method

Click Add Payment Method

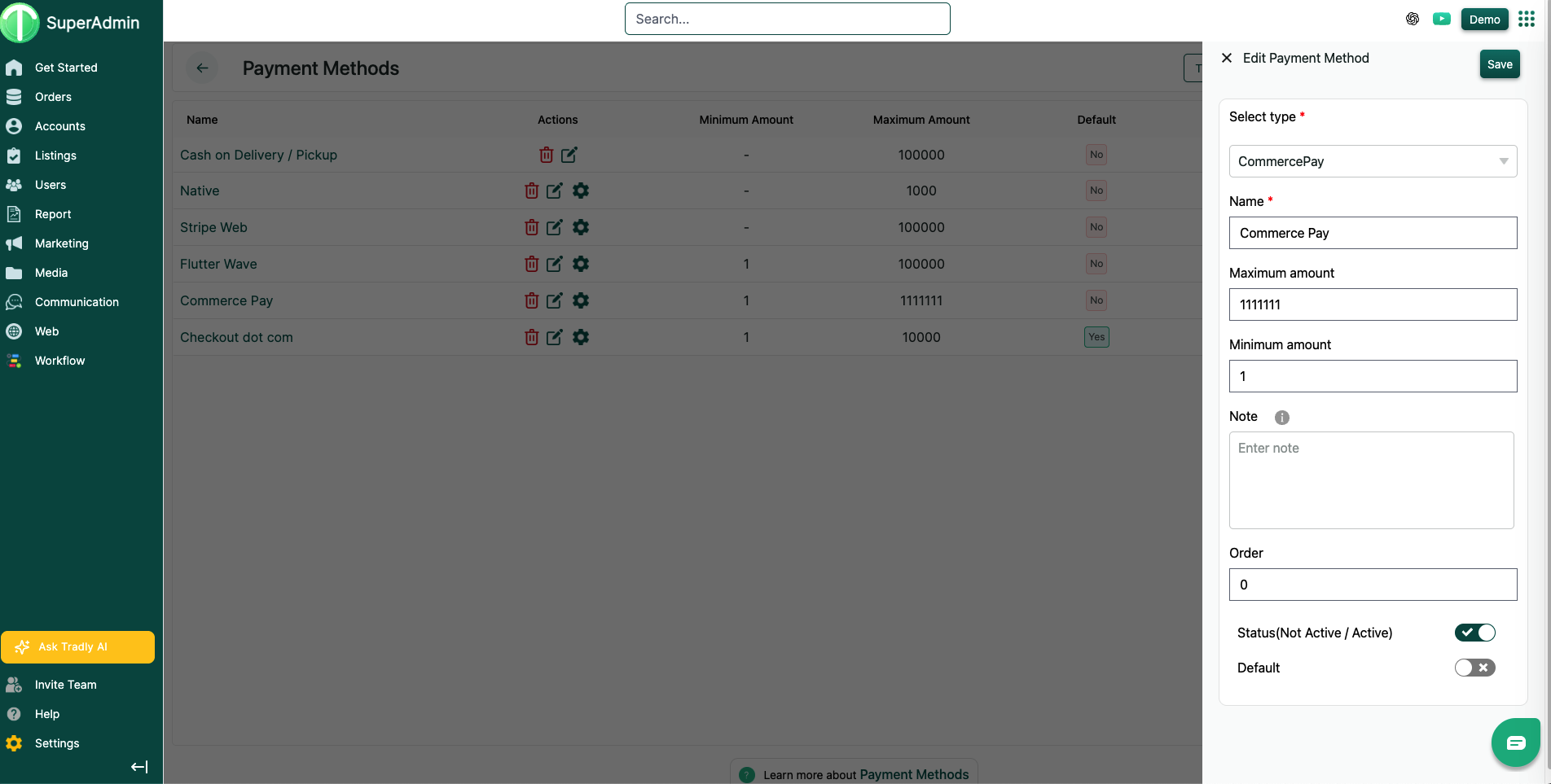

Choose:

Field | Value |

|---|---|

Select Type | CommercePay |

Name | “CommercePay” |

Minimum Amount | Optional |

Maximum Amount | Optional |

Status | Active |

Default | Enable if you want CommercePay as the main method |

Click Save.

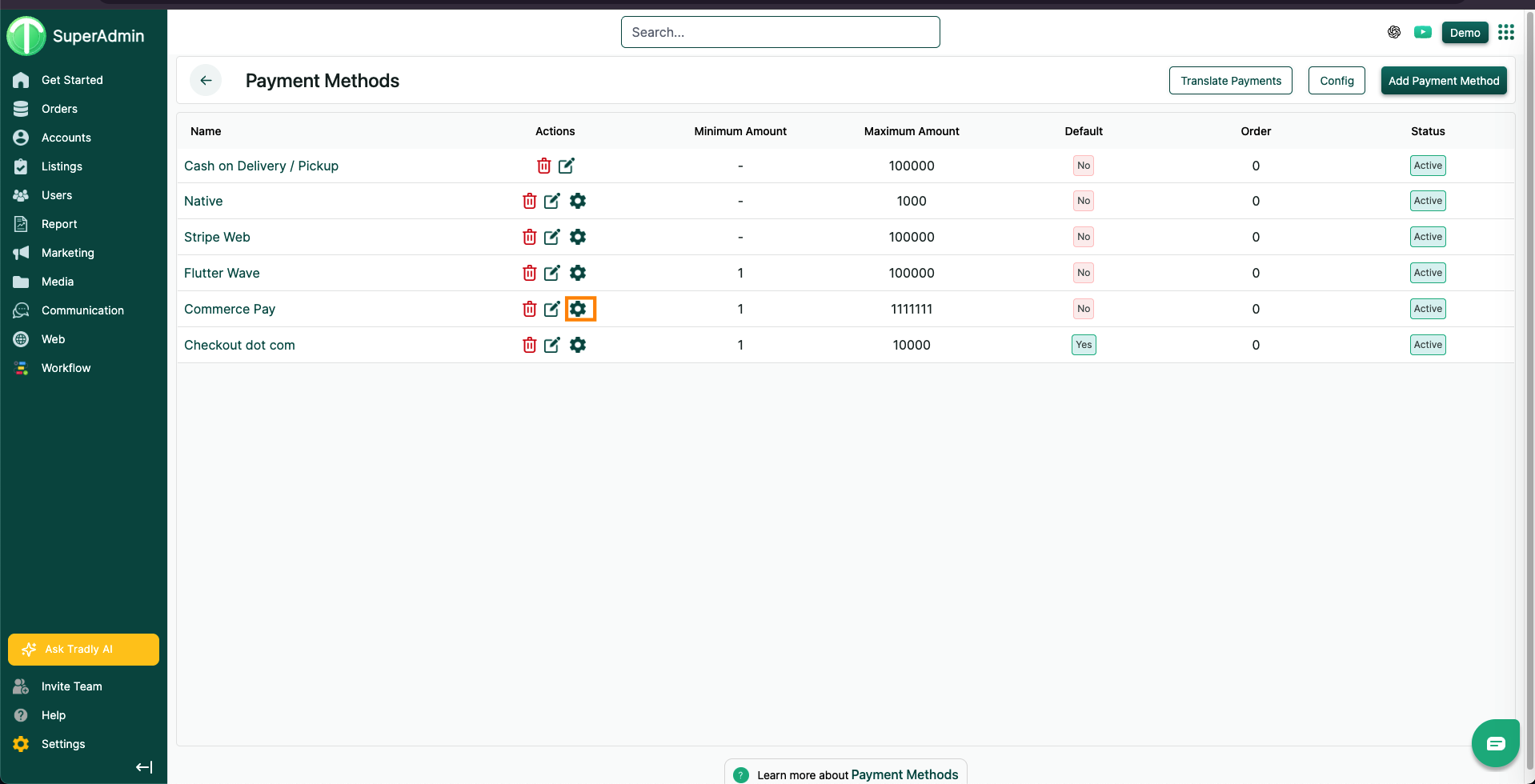

Step 4 — Open CommercePay Integration Settings

Click the Gear icon next to CommercePay.

You will see fields like:

Enable CommercePay

API Token / Secret Key

Merchant ID

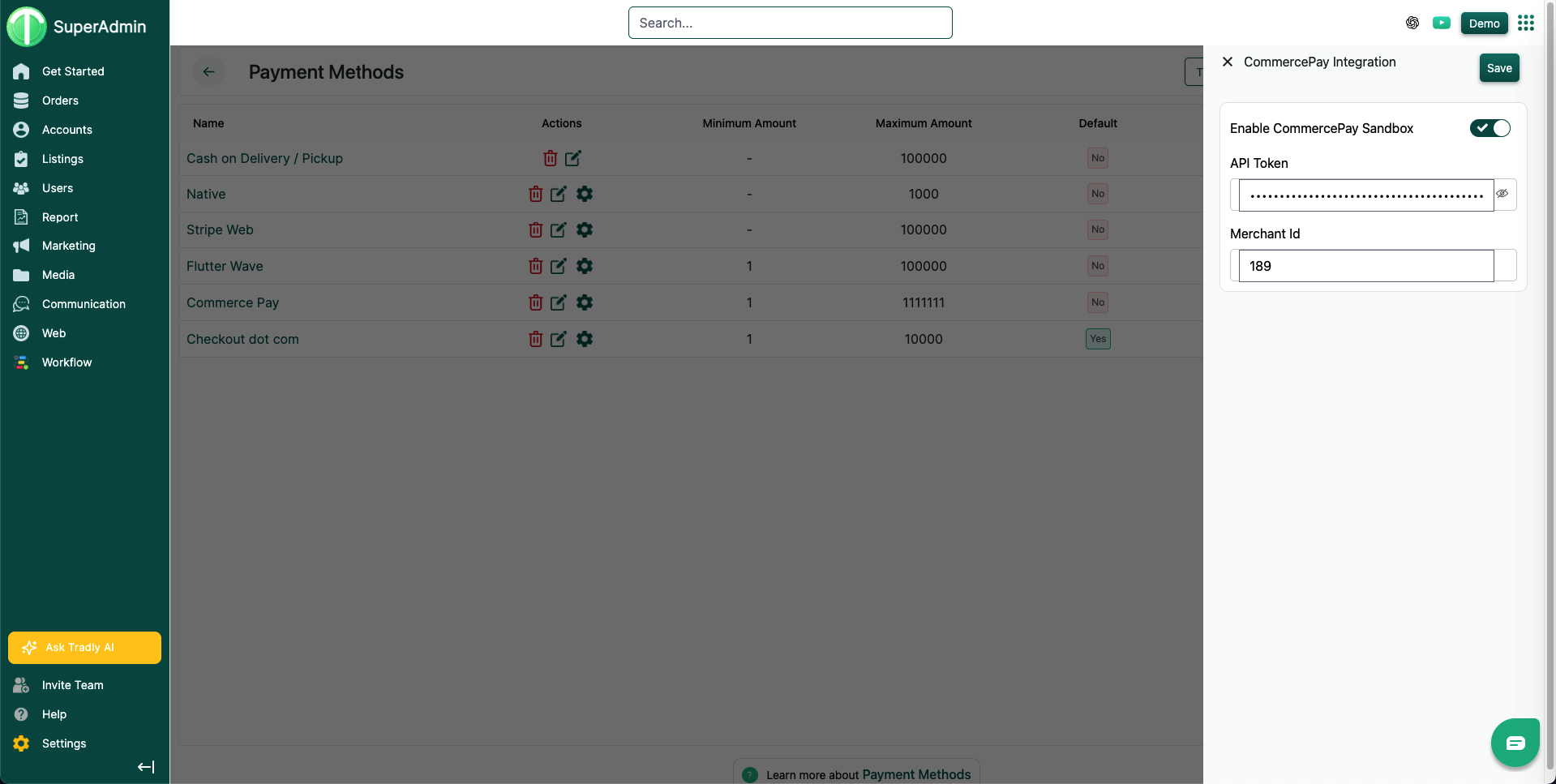

Step 5 — Enter CommercePay Credentials

Field | Description |

|---|---|

Enable CommercePay | Turn ON |

API Key / Secret Key | Paste the long secret key from CommercePay |

Merchant ID | Enter your Merchant ID (e.g., 189) |

Sandbox Mode | Only enable if CommercePay provided a test environment |

Click Save.

Testing & Go-Live Notes

If CommercePay provided a Sandbox/Test Mode:

Enable Sandbox inside Tradly

Use the test API Key + Merchant ID

For Live Mode:

Make sure Sandbox is OFF

Use your Live keys from CommercePay

Ensure your bank account is verified inside CommercePay portal

Want more Integrations?

Post your ideas and request in our community forum.